Kauffman Fellows recently published their first-ever Fund Returners Index report!

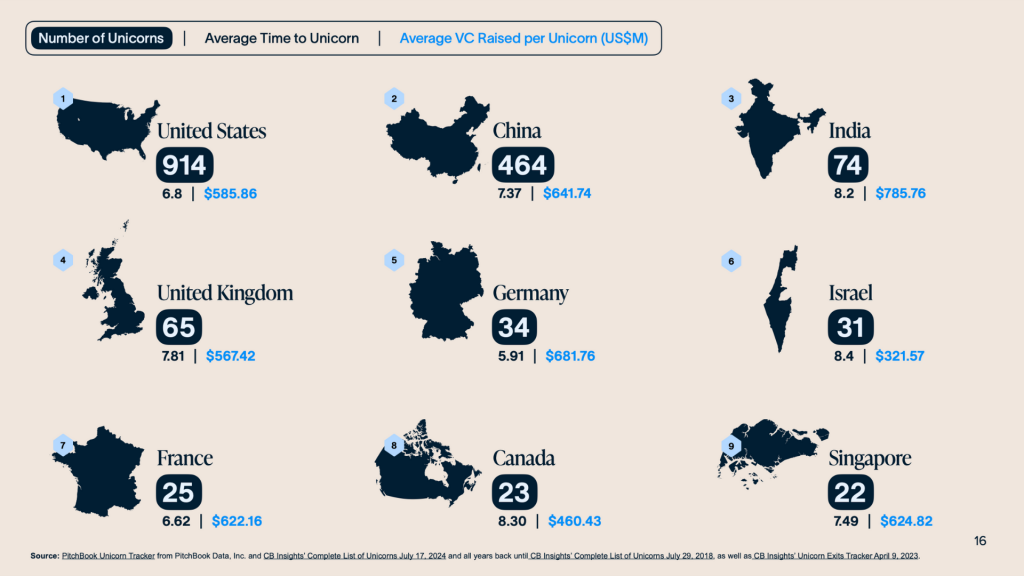

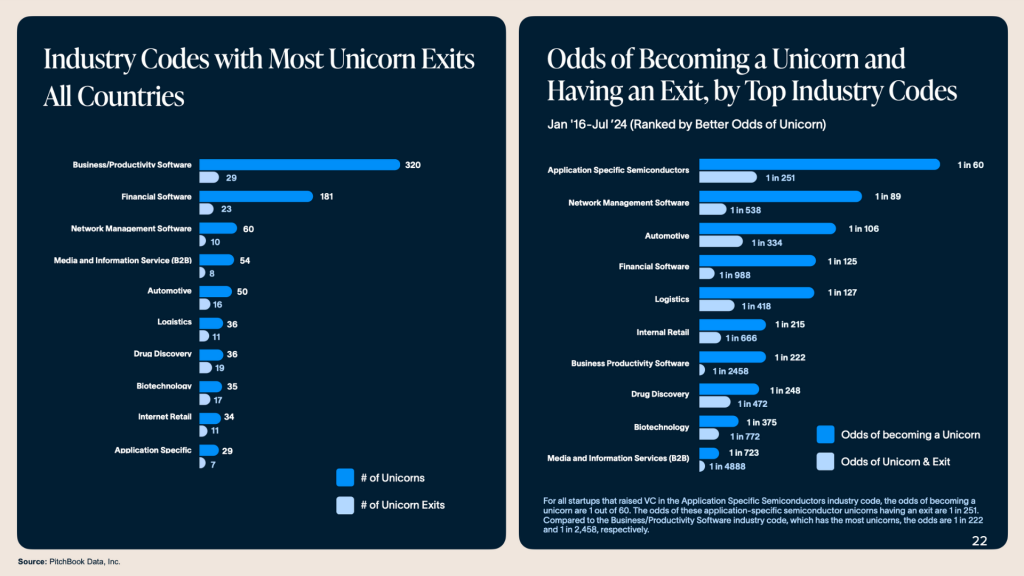

The report first highlights total unicorn activity in the world since 2016 by country and industry sectors. The report also introduces the Fund Returners Index, which measures the success of a venture capitalist through their ability to invest in category-defining (billion US$ companies) and firm-defining startups (billion US$ exits) through three metrics

- the number of attributable investments by a VC in startups that went on to become a unicorn after their investment (a proxy for finding, investing, and supporting category-defining startups);

- the total number of attributable unicorn exits;

- and the sum of those unicorn exits valuation (the last two as proxies for investing in firm-defining startups).

More information in the Fund Retuners Index Report webpage.

The report also publishes the Top 50 fellows based on a weighted ranking (33% each) of the metrics above. Our founding managing partner Yinglan Tan, from the Kauffman Class 15, is third on this list, and the only one from Southeast Asia in the top five.

“Venture capitalists can only become as great as the best companies they invest in. This ranking reflects the resilience of the founders and companies we have partnered with and quality of the partnerships we have embarked on over the years. Amidst the turbulence in today’s capital markets, this report is reminder of why we are in this business — as Kauffman Fellows puts it, to enable entrepreneurs to tackle the world’s most pressing challenges.” shares Yinglan.

Insignia Ventures Partners’s unicorn portfolio companies include the likes of Carro, Ajaib, GoTo, and Appier.

The report also features other interesting takeaways:

(1) Unicorn minting since 2016 peaked at 2021, and has only dropped since, with 2024 being the second weakest year in this period (the lowest was 2016). This reflects a cyclical fluctuation of the funding landscape amidst the ZIRP (zero-interest rate policy) years. Having gone through one cycle of boom and bust, what kind of unicorns will Southeast Asia produce in the next one? We explore this evolution towards more global category leaders (as opposed to single market or regional market leaders) in this article.

(2) Singapore ranks ninth among countries minting unicorns from 2016 to 2024, and Indonesia 18th. Singapore’s ranking represents less the addressable market opportunity of the country as it does the attractiveness of the city-state to entrepreneurs to set up headquarters to build global-scale companies.

From the Kauffman Fund Returners Index Report

(3) Business / productivity software and financial software top industry codes that have minted unicorns. With the advent of AI taking SaaS into a new era of software, this dominance is unlikely to change.

From the Kauffman Fund Returners Index Report

For inquiries, email pr@insignia.vc.