Highlights: Careers Emerging from Southeast Asia Innovation Trends in 2023

- Careers Tied to Data Value Chain and AI application development

- Careers Tied to Software and Technology Commercialization

- Careers in Agriculture

- Careers in Developing Rural Areas

- Careers in Unlocking Financial Services for Companies (interoperability, risk management / transaction validation, infrastructure)

- Careers in Finance, Cybersecurity, and Monetization Strategies for Enterprise Risk Management and Sustainability

- Careers in Unlocking Destination Markets for Southeast Asia startups (e.g., Japan, Latin America)

As we navigate through the midpoint of 2023, it is essential to reflect on the significant innovation trends shaping Southeast Asia’s landscape. These innovations are not just transforming the region’s business and economic environments but are also moulding the future career opportunities for the next decade. Here, we have extracted wisdom from several leaders on the On Call with Insignia podcast, drawing their experiences and perspectives to shape a clearer picture of these exciting trends.

(1) AI Beyond GPTs: Careers Tied to Data Value Chain

The democratization of AI capability acquisition brought by models like GPT hinges heavily on the presence of high-quality, relevant data. The future seems particularly promising for organizations that are rich in structured, quality data, potentially transforming AI experiences. This means careers tied to building and leveraging tools to tap into these data sets and develop hyperlocalized or customizable applications will be in greater demand in this decade.

Data sets and the ability to leverage these for AI applications are the new moats for software companies

Shinji Asada, CEO and co-founder, general partner of Japanese SaaS VC firm One Capital shares on our podcast: “And I think the companies that will do well are companies or SaaS companies that are a system of record that have enough data within their product set, either from a product standpoint or from a user standpoint, and utilize that data to make the experience better. So those are the companies that are going to do well. The companies that might struggle or even become obsolete are ones that don’t have data. Like it’s not a system of records, maybe a system of engagement, but I think those will be challenging, right?”

Christian Schneider, CEO and co-founder of data processing and workflow automation platform bluesheets, shares on our podcast: “Having that data infrastructure in place is key and that’s going to be a deciding factor as to who’s gonna own industries in the future, it’s going to be those companies who have the best data sets, the richest data sets, the ones that are most complete with the least anomalies and incompletion in general. So having that coherent sort of data set is going to elevate our customers and we very well understand that. And I think in this particular client case that was mentioned, the client really understands that as well. So they’re really looking into digital transformation from that perspective.”

Experienced humans are still needed to guide AI development

Dino Setiawan, CEO and co-founder of supply chain financing and SaaS for Indonesia’s FMCG MSMEs AwanTunai, shares on our podcast: “My chief science officer once said that artificial intelligence can’t beat a trained human. At first, I was surprised by this statement since we are always sold on the idea that AI models can process 50,000 variables, whereas humans cannot. However, she made an excellent point regarding structured and unstructured data. Deep learning models need tens of millions of data points and users, and only a few companies have access to these data sets…understanding risk management is critical before building science models that can surpass human performance. And to get the right set of variables and proxies, experienced humans need to guide AI engine development.”

(2) Automation for Business Beyond Bots: Careers Tied to Software and Technology Commercialization

Digital transformation is about more than just automation itself. It requires agile execution, the ability to navigate rapidly changing regulations, and a commitment to market education and collaboration, especially in markets that are going digital or online for the first time, or having to abandon longstanding behaviors or beliefs. These challenges in driving digital adoption make commercializing software and technology expertise, which requires a nuanced understanding of these factors, all the more important as Southeast Asia’s digital economy continues to reach even more untapped businesses and consumers.

Adaptability to maturing regulations is key

Vivi Mandasari, COO of AI-driven identity verification solutions platform Verihubs, shares on our podcast: “If we describe the COO in Verihubs, [they] should be a very hard and agile person because regulations are changing massively. So we need to adapt [Verihubs] faster and we should prioritize the safety and reliability of our services, even small mistakes in every choice because it will be fatal for our clients’ business security and our reputation itself. If you ask me [what it’s like] to become the COO for Verihubs, it’s like I’m becoming a parent in the company.”

Facilitating market education and collaboration can be valuable long-term for early-movers in nascent markets

Frank Ng, Head of Marketing at mental health tech platform Intellect, shares on our podcast: “I think in the mental health space, while competitors do exist, it’s much more about building the pie versus carving out the pie, if that makes sense. Building the pie to me is purely about an education game. Realizing and acknowledging that people haven’t spent time buying and procuring mental health solutions in the past decade.

If you survey a bunch of HR professionals and leaders, that’s not something that is on their top common list. You have your usual HRMS, HRIS, talent acquisition, employee engagement, and employee listening vendors, but not so much on mental health. So that’s where a key play for us has been to look at building education in the market via, as mentioned earlier, the donut model and other frameworks.”

Jessica Hendrawidjaja, CMO of Indonesian logistics-first ecommerce enabler Shipper, shares on our podcast: “There has been a global fear of an impending recession, and that this will impact businesses all across the globe, especially SMEs…we will be having these major legendary brands in Indonesia to share insights and stories about how they grew their business over the decades…SMEs can get insights on how to stay in business for decades because all these businesses have gone through multiple crises and recessions…legacy brands continue to look for ways to connect with the market and do market regeneration…new brands, the ones that are pretty much focused on e-commerce, can help these legacy brands to learn about and they can possibly group together through collaboration.”

(3) Agriculture Beyond Farm-to-table: Careers in Agriculture

The innovations in agriculture are seeing a shift towards the upstream and middle chain. There’s a rising demand for increased productivity, efficient distribution, and a stable supply-demand equilibrium, which points towards promising career opportunities in these industries, as businesses seek to increase income generation from these sectors by disrupting production, pricing and distribution inefficiencies.

Fisheries Iron Triangle in Indonesia is being funded and built out, showing promise for jobs in this sector

Brian Wong, author of the Tao of Alibaba and longtime former Alibaba exec, shares on our podcast: “Another area that I think is interesting is how these companies have adopted technology to their own local markets. In the fisheries industry, there’s a company called E-Fishery, which I think is doing very well in Indonesia, but it’s growing to other markets. It’s even looking at expanding into China. Who would’ve thought that you could apply e-commerce and FinTech to the fisheries market? That’s something that I think really was pioneered in Southeast Asia…it also shows that what you call — indigenous or local innovation — is very rich in terms of how it evolves and takes its own path.”

(4) Digital Economies Beyond Urban Areas: Careers in Developing Rural Areas

The digital economy is no longer confined to the urban areas, with the untapped potential in rural areas becoming increasingly apparent. Businesses are looking to penetrate these markets, leading to the creation of new career opportunities centered around rural development.

Untapped spending / purchasing power in rural Indonesia

Jessica Hendrawidjaja, CMO of Indonesian logistics-first ecommerce enabler Shipper, shares on our podcast: “We have the largest population in Southeast Asia, and we haven’t tapped everyone yet. That’s definitely an opportunity that all these brands, legacy or new ones, need to tap into, especially during the recession. The ones that have purchasing power are no longer the only ones that live in first-tier cities. The ones living in second and third-tier cities have purchasing powers but don’t know how to buy. So the question is how to enable that, right? So I think that’s a massive opportunity…So interestingly, SME business owners in second and third-tier cities are the most enthusiastic ones…”

Gisella Tjoanda, VP of Business Development at social commerce for rural Indonesia platform Super, shares on our podcast: “For private label brands, at first we were focusing on FMCG products, but then we started to tap into the cosmetics industry for both private label and distributions…the cosmetics industry has grown quite significantly in the last few years, in fact, the revenue for cosmetics market is amounting up to USD7.4 billion in 2022…Usually, it’s double-digit margins for cosmetics…

We’ve seen a particular pattern in smaller areas where things need to be trending or viral in the bigger cities before it actually enters smaller cities…there is predictability in the cosmetics business. We basically can predict when the products will run out and when the customers will usually repurchase…making us believe cosmetics is a great idea for us to start a private label.”

(5) Fintech Beyond Fintechs: Careers in Unlocking Financial Services for Companies

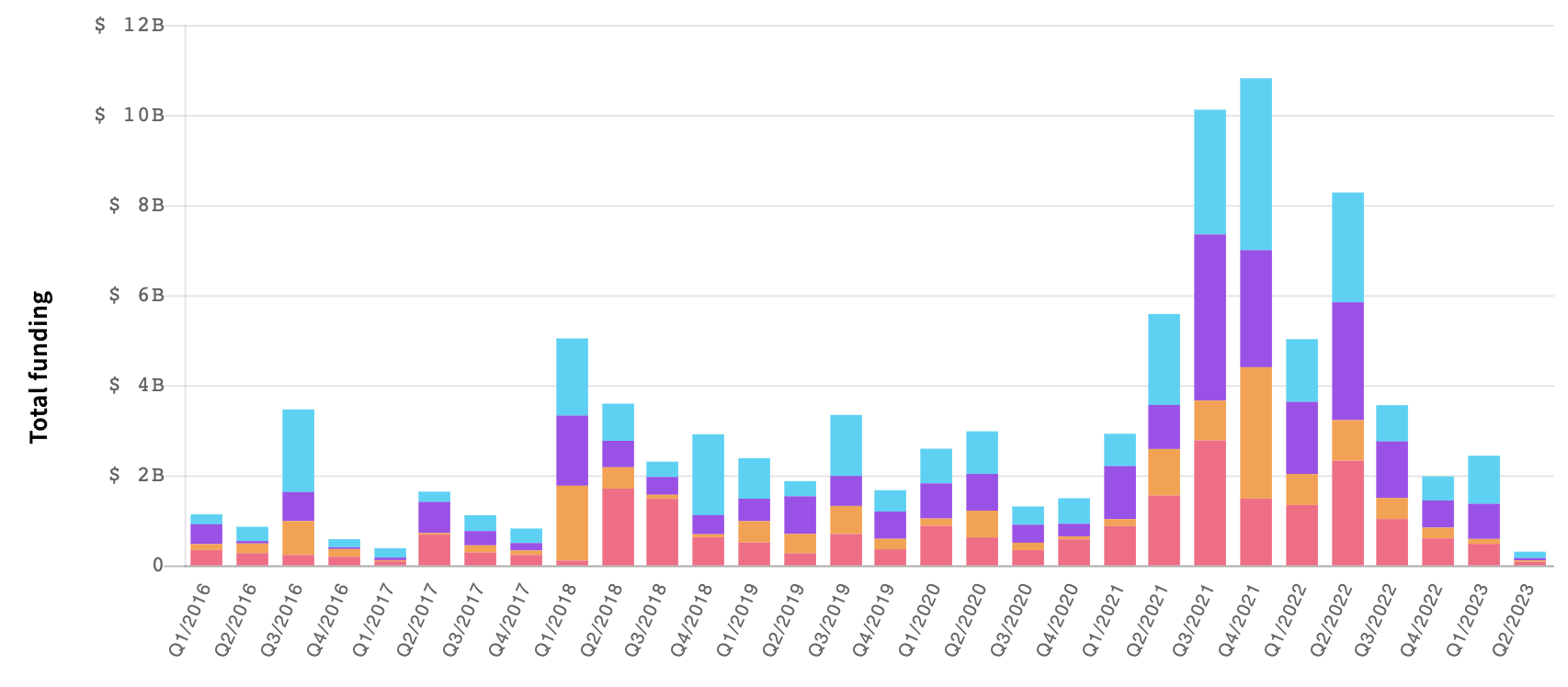

As the financial industry continues to mature in Southeast Asia, fintech is becoming a key driver for many businesses. Even from a venture capital investment standpoint, it continues to be one of the more resilient sectors amidst the current market headwinds.

Private funding per sector across SEA markets. Taken from insignia.vc’s private markets statistics tool. Light blue is for commerce, purple is for fintech, orange is for consumer, and light red is for information technology.

However, it’s not just the pure fintech companies that are benefitting from this trend. Now, businesses in other sectors are harnessing fintech to streamline operations, optimize efficiency, and offer better services to their customers. Roles or functions dedicated to unlocking these functionalities will be critical even for non-technology companies.

Solutions for interoperability, risk management, and infrastructure will be important for fintech to truly be “everywhere”

Jui Takle, Strategic Development at Tonik, shares on our podcast: “What it lacks is interoperability between the digital banking platforms and payment systems, which is a major obstacle in the growth of digital banking in Southeast Asia. Interoperability allows seamless transactions between digital platforms and systems, just like how it is in India with UPI. In any ecosystem, the first thing that develops is payments and then the rest follows. So I would say that there is still some time for Southeast Asia to mature.”

Dino Setiawan, CEO and co-founder of supply chain financing and SaaS for Indonesia’s FMCG MSMEs AwanTunai, shares on our podcast: “We’ve seen a lot of folks with mountains of GTV really struggle to try and monetize that through financial services, namely lending because it’s such a high-margin business. But for us, validating is really the key to enabling this financing to work, right? We have 3 billion USD in sales, and we’re able to lend well over 800 million USD on an annualized basis. So that’s a really high ratio.”

Vivi Mandasari, COO of AI-driven identity verification solutions platform Verihubs, shares on our podcast: “Currently our technology is mostly needed by financial institutions or FinTech…as one of the main “backbones” in order to build a safe and confidential digital financial ecosystem for their stakeholders…We have some kind of use case for the hospitality and education [establishments]. So all our products are more adapted for other industries right now, but for the main use cases, it’s still for KYC…”

(6) Risk Management and Building for Company Sustainability Beyond Company Boards: Careers in Finance, Cybersecurity, and Monetization Strategies

While risk management and sustainability have traditionally been the responsibility of company boards, in today’s tech-driven world, these areas require specialized expertise. As such, there’s a growing demand for professionals with skills in finance, cybersecurity, and monetization strategies. These roles are essential in helping businesses navigate challenges and ensure long-term sustainability.

Finance functions in the driver’s seat of businesses

Joel Leong, CMO of finance OS for businesses Aspire, shares on our podcast: “Basically businesses have had to readjust themselves multiple times in these two years. And I feel like all of this kind of brings finance back to the driving seat of the business. Because there are a lot of financial decisions here…for all these you actually need data and you need the right analysis from your finance teams to actually guide you.

With this community, what we felt we could do…one was to celebrate the role of finance in business and bring them back to the driving seat, bring finance leaders into the conversation with the business leaders as they should to drive the business forward…the other thing was also to provide an opportunity for finance leaders to learn from each other.”

From Acquisition innovation to Monetization innovation and the experimentation necessary to do the latter efficiently

Gita Prihanto, COO of Indonesian P2P fintech Flip, shares on our podcast: “Also in line with what we’ve seen right now with the economy, this year is going to be a definitive year where I’m excited to see how technology companies innovate to scale monetization, especially in the Indonesia consumer market, because the current economic and market conditions definitely put pressure to everyone and to all tech companies.”

Nadira Zahiruddin, Head of Innovation Strategy at social commerce for rural Indonesia platform Super, shares on our podcast: “What we do at Super is we also do a lot of testing or experimentation for different kinds of products. So this is something that we do continuously before we actually decide on which brand we want to focus on or which type of SKUs that we wanna focus on. Because again, since every area has different preferences, what we do is we usually experiment on a smaller scale first with maybe second-tier brands. And then once we do see which are the winning products and really see which products have really big potential, then we focus on those types of products from the experimentation results.”

(7) Market Expansion Beyond Southeast Asia: Careers in Unlocking New Markets

The desire to expand into new markets is a shared goal for many Southeast Asian companies. While the region offers abundant opportunities, venturing beyond its borders can bring additional rewards, especially in markets that are also rapidly growing (i.e., similar pain points) and have massive market potential. However, cracking new markets often requires a nuanced understanding of local needs, culture, and business environments. Thus, roles focused on market research, localization, and business development in international contexts are becoming increasingly crucial.

Latin America as a destination market for SEA startups

Hernan Kazah, Kaszek Ventures Co-Founder And Managing Partner, shares on our podcast: “I think the kind of gaps or underserved markets that we have in Latin America are similar to those that you may encounter in Southeast Asia. So if someone is solving something for the education sector or for the distribution sector or something around healthcare in Asia, probably the same problem is in Latin America. So then how you apply that solution to that market, you might need to adjust things here or there, but I think the root of the problem is probably the same one.”

Japan as a destination market for SEA startups

Shinji Asada, CEO and co-founder, general partner of Japanese SaaS VC firm One Capital shares on our podcast: “I see it’s probably a hard market to crack because of the language barrier and the cultural barrier, but at the same time, it’s a big market. It’s the third-largest economy in the world. Especially around enterprise software, it is the second-largest market after the United States. Let me give you some figures. It’s about 280 billion on an annual spend basis, and a lot of that is dominated by legacy software that I just mentioned when I was using it at ITOCHU. So it’s a low-hanging fruit [market] if you have a great user interface experience.”

The seven innovation trends identified in the first half of 2023 indicate the potential for significant career opportunities in the Southeast Asian tech industry over the next decade. These areas – from AI to fintech to risk management – highlight the region’s dynamic nature and its willingness to embrace new technologies and ideas. The expert insights shared in this podcast reaffirm the vast potential of Southeast Asia as a thriving hub for innovation, entrepreneurial growth, and career advancement.

Paulo Joquiño is a writer and content producer for tech companies, and co-author of the book Navigating ASEANnovation. He is currently Editor of Insignia Business Review, the official publication of Insignia Ventures Partners, and senior content strategist for the venture capital firm, where he started right after graduation. As a university student, he took up multiple work opportunities in content and marketing for startups in Asia. These included interning as an associate at G3 Partners, a Seoul-based marketing agency for tech startups, running tech community engagements at coworking space and business community, ASPACE Philippines, and interning at workspace marketplace FlySpaces. He graduated with a BS Management Engineering at Ateneo de Manila University in 2019.