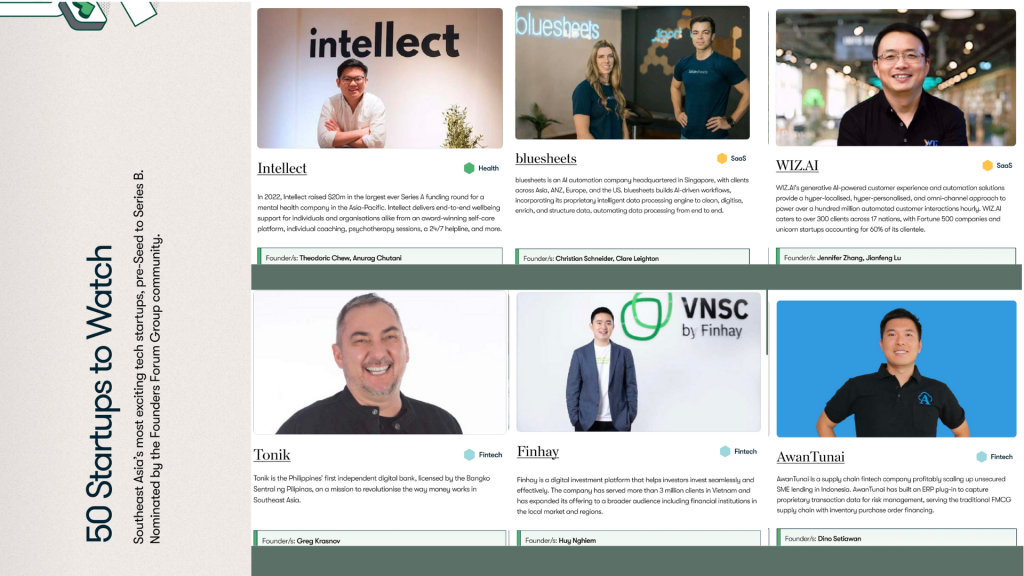

Founders Forum Group recently published its Destination Southeast Asia Report 2024, in partnership with the Singapore Economic Development Board. It featured interesting stats on funding in the region over the last five years, insights from VCs including our founding managing partner Yinglan, and several of our portfolio companies in the top 50 startup to watch: Intellect, bluesheets, WIZ.AI, AwanTunai, Tonik, and Finhay.

Insignia Ventures Partners portfolio in Southeast Asia’s Top 50 Startups to Watch

Interesting stats from the report

- Global funding: 83% of investment in SEA tech startups came from overseas in 2023. In 2023, 83% of VC investment in SEA tech startups came from outside the region, mostly from the rest of Asia (59%), the US (14%), and Europe (9%). H1 2024 saw an increase in the share of investment from the US. We write about companies raising from global investors as part of this “globalization” of the Southeast Asia startup.

- Martech funding: Second highest sector to raise funding was Marketing & Martech (US$2.2B out of US$8.9B in 2023, +434% increase from the last five years). This sector includes chatbots, social media startups, CRMs, marketing SaaS, and productivity tools. This points towards the impact of AI, including generative AI, in driving demand for better SaaS tools.

- Southeast Asia vs the world: Southeast Asia’s valuations remain on an upward trend compared to other emerging markets and startup hubs across the world. “Singapore’s tech startup scene is valued at more than startup hubs like Hong Kong and the UAE combined…Startups in Singapore alone attract more investment than those in Oceania and other global startup hubs, including Hong Kong and the UAE.”

5 Takeaways from Yinglan’s sharing in the report

(1) A great app is not enough

We broadly look at product-market fit, founder-market fit, and investor-founder fit. In SEA, with thinner margins and more price-sensitive customers, product- market fit is just as much about efficient distribution. We’ve learned from companies like Super and Fazz that a great app is not enough, especially in traditionally offline or rural market segments, where social interactions are key. Founder-market fit in SEA is also about regulatory relationships and socio- cultural understanding. With investor-founder fit, the question is: Are we the best partners for the entrepreneurs and their business? We need to build a relationship of trust.

(2) AI companies have potential to be global leaders

AI companies able to commercialise in spite of the region’s nascency hold massive potential to be global leaders given the advantages of starting from Southeast Asia’s emerging markets. Companies like Appier or WIZ.AI are on this path. There is also opportunity in bridging the gaps between the infrastructure behind AI (GPUs and semiconductors) and real, commercial use cases.

(3) One market or just SEA might not be enough

Fintech solutions being integrated into more customer journeys opens up greater opportunities for platform growth and retention. Carro is an example of leveraging these adjacencies to great effect. Healthcare is also key with greater spotlight on issues like mental health, where companies like Intellect have been working to create more accessibility to mental health care through companies and insurers. Across industries, there is also greater interest in the ability of SEA companies to go multi-market or beyond the region.

(4) Not all Southeast Asia markets might be suited for your business’s go-to-market

Each market in Southeast Asia has its own strength, and not necessarily as a go- to-market. Regional companies in our portfolio like Carro have strategized their allocation and focus across markets depending on local resources and costs, demand and competition in their industry, and unit economics. Hypothetically, Singapore may be a destination to set up corporate headquarters, but operations may be better placed in Malaysia and the Philippines. Engineers may be better sought after in Vietnam.

(5) How are you doing with regulators?

It’s also important to work closely with regulators to build trust and industry maturity. ASEAN regulation has been quicker to react than regulation in the West and governments are typically more open as well to co-development of regulation through sandboxes and frameworks. Historically this has been led by precedents and examples set by Singapore, especially in the financial services space.

Paulo Joquiño is a writer and content producer for tech companies, and co-author of the book Navigating ASEANnovation. He is currently Editor of Insignia Business Review, the official publication of Insignia Ventures Partners, and senior content strategist for the venture capital firm, where he started right after graduation. As a university student, he took up multiple work opportunities in content and marketing for startups in Asia. These included interning as an associate at G3 Partners, a Seoul-based marketing agency for tech startups, running tech community engagements at coworking space and business community, ASPACE Philippines, and interning at workspace marketplace FlySpaces. He graduated with a BS Management Engineering at Ateneo de Manila University in 2019.