Fintech in Southeast Asia gained historic momentum over the past year. Singapore, Malaysia, and the Philippines made headway in their digital bank license programs with new and existing banking players placing their flags in uncharted territory. Indonesia introduced new regulations to force traditional banks to work more closely with startups or consolidate.

Digital payments and wealth management platforms saw massive adoption as consumers avoided physical bank branches, moved their ecommerce transactions online, and looked for new ways to earn amidst the pandemic’s cash crunch on households.

Finally, the key battlefield of Southeast Asia’s tech landscape has shifted from ecommerce and ride-hailing to fintech. Regional tech heavyweights like Grab, Gojek (GoPay), and Sea (ShopeePay) compete over dominance in the payments space, drawing in late-stage investors specifically for their payments businesses. To stay ahead, banking incumbents are exploring new forms of collaboration and partnership with startups and tech companies through API calls (think Stripe), creating new space for fintechs in the region to focus on infrastructure.

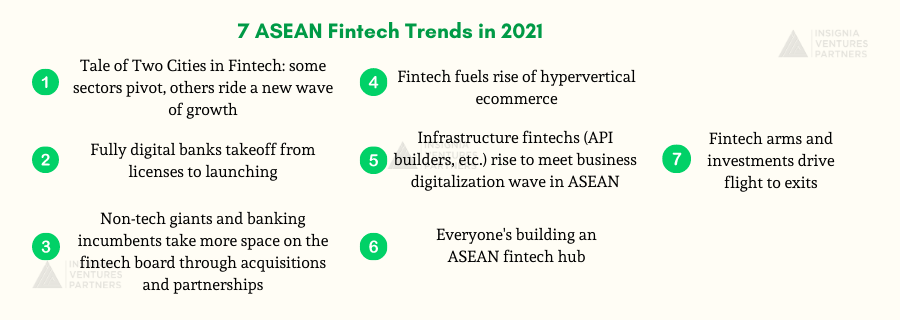

We recap some of the key trends from 2020’s fintech space, and what it means for 2021 and beyond:

- Tale of Two Cities in fintech: Some fintechs rode a new wave of growth with more digital migrants, others had to pivot or perish due to low incomes, but those that did (pivot) will come out stronger in 2021.

- Digital Banks takeoff from licenses to launching: With licenses released in Singapore, Malaysia, and the Philippines opening up applications, and Indonesia’s OJK issuing more licenses for fintechs, the digital banking playground is now set for contenders to test and launch their offerings for consumers in the next two to three years.

- Enter the dragons: Banking incumbents and non-fintech tech giants have also been entering the fintech ring, whether through infrastructure partnerships with startups or participating in the digital bank license races, which will have a significant influence on the distribution of capital into Southeast Asia’s tech sector.

- Fuelling hyper-vertical commerce’s fintech needs: With the emergence of hyper-vertical commerce marketplaces built around specific, long-term/recurring lifestyle purchases, like cars or property, payments and financing is a crucial point in the customer journey and thus these companies will be investing more into the fintech space.

- Rise of the infrastructure fintechs: The movement of banking incumbents and non-fintechs into fintech means a greater demand for Stripe-like companies that are able to bridge banking functionality at scale to consumers and businesses through API integrations and open banking.

- Everywhere’s an ASEAN fintech hub: Over the next decade, we’ll see governments rush to develop their regulatory regimes and position themselves as an ideal nesting ground for fintechs in the region.

- Flight to Exits: With greater later stage deals versus early-stage deals on the decline (relatively) across Southeast Asia’s tech companies, and the more capital expected to go to fintechs, we can expect more tech companies to exit that is either fintech in nature or have been leveraging fintech arms to grow.

For more insights and data on the fintech in Southeast Asia, check out UOB for their annual Fintech in ASEAN report, where we also share some of these insights alongside fintech investors and founders like tonik’s Greg Krasnov.

(1) “Tale of Two Cities” in Fintech

The “Tale of Two Cities” narrative where companies either won big or were struck hard by the pandemic extends to the fintech space. Fintechs generally benefit from the digitalization accelerated by the pandemic. At the same time, the COVID19 strain on economies also led to a cash crunch, which put certain fintechs in more of a quandary than others.

Rising above the pressures on lending and financing sector

Lending startups had to adjust credit assumptions and rethink business growth, and regulators had to issue new lending regulations. This likely resulted in investors being a bit more sluggish in this sector. But in the case of AwanTunai, because their financing platform catered to MSMEs that remained opened amidst lockdowns (i.e. stores selling groceries, FMCGs, fresh produce), they were able to maintain healthy repayments numbers. And instead of expanding to new customer segments, which they initially planned, they focused on fast-tracking product development and opened up new revenue streams for their existing customer segment.

Rise of digital wealth management

On the other hand, wealth management startups rode a new wave of growth as consumers look for ways to keep their savings productive amidst the cash crunch. There also appears to be a decoupling of equity markets from economic realities on the ground, which first-time retail investors are looking to cash into.

We saw this with Ajaib in Indonesia growing more than 40x over the first half of this year, acquiring a stock broker to become the first digital brokerage in the country in June, and six months later becoming the top 6 stock brokerage in Indonesia in terms of trades. We also saw this positive impact with Finhay in Vietnam, as they launched a money market fund product this year and saw their traction increase by more than 10x this year.

(2) Licenses to Launching: Digital Banks Takeoff

The rebundling of banking services and creation of digital banks from scratch among fintechs is something we’ve written and talked about so many times over this past year, and for good reason. This rebundling trend aligns with the greater spotlight on digital banks, with regulators in at least three countries in the region (Singapore, Malaysia, Philippines) offering licenses. While there are players who are non-endemic to the fintech space, tonik, for example, has been building its proposition from the ground up — that is to say, it is a purely digital bank.

Moving into 2021, we will see how the winners of the license race will now work to build and launch their services to the masses. From the regulators point-of-view, it will also be interesting to see how they will engage with these existing contenders and entertain new entrants in the future.

While this evolution in fintech business models has been ongoing even before COVID19, the crisis has only accelerated adoption of fintech apps, and this consumer shift has opened doors for fintechs to expand their services even faster.

(3) Enter the dragons: Non-fintech giants

We will see more downstream consolidation in consumer-facing fintech services, especially as local tech companies expand into fintech and traditional players try to participate more actively in the space. At the same time, this opens up room for players to evolve their business models, either to compete with or enable these consolidating forces. The digital banking races across the region is more of the former, where tech companies will compete in their propositions to consumers.

This shift into fintech is the next step for these consumer platforms that are making the super-app play and looking to capture the entire customer experience of their already massive user base. Investments into the region’s tech sector will slant heavily towards fintech lines of business in the next few years.

(4) Fuelling hyper-vertical commerce’s fintech needs

Another interesting trend is the expansion of hypervertical platforms (companies focused on building services around specific customer journeys) into financing. Carro has already done this with Genie, its financial arm, leveraging massive data sets collected from transactions to underwrite car loans.

(5) Rise of the infrastructure fintechs

Traditional banks and other tech companies (e.g. ecommerce platforms) venturing into fintech opens up opportunities for fintech enablers — companies that create the APIs and software for banks to digitize processes or developers to write their own fintech apps. This is a significant development considering Stripe has been expanding its Asia presence over the past year.

(6) Everyone eyeing to be an ASEAN fintech hub

In terms of markets, we have seen that regardless of the market, fintechs have been benefiting from the tailwinds of COVID19 (e.g. comparing the growth of Ajaib in Indonesia and Finhay in Vietnam), along with similar government support across the region towards financial inclusion. The difference lies in the speed and direction of growth for these fintechs, in which both consumer behavior and regulatory capabilities will be crucial, intertwined factors.

(7) Flight to Exits

Greater amounts of capital are being directed at later stage investments, especially from investors outside of Southeast Asia. This is in contrast to data we’ve seen on early-stage deals which have been on the decline. The funding is likely going to many of the larger players that are riding on COVID’s digitalization tailwinds and seeking to retain or strengthen their market leadership. One concrete example of this in the fintech space is Facebook and Paypal’s investment into Gojek’s Gopay. From the Southeast Asia investor’s perspective, there’s more pressure amidst the crisis and the liquidity push in the region to close in on the stronger bets in the portfolio and ferry them to sizable exits.

ASEAN’s Multiple Market Advantage

The crisis has proven to be an opportunity for fintech firms to drive adoption in Southeast Asia. The challenge now, especially for those that have experienced an uptake in transactions or users, will be to sustain this growth. Instead of looking at product-market fit as a single milestone achieved early on in company growth, think of it as a continuous process that has to be accomplished at every stage of growth. Fintechs that have mastered scale and achieved profitability were able to grow from strength to strength, finding new opportunities or use cases for a product-market fit that were not in the market before.

Southeast Asia is five to ten years behind China, but the key difference here is that we are talking about multiple markets instead of one massive market. Through the expansion narratives of companies like Alibaba and Ant in the region, we have seen how it can be challenging even for a well-resourced and highly capable player to create a unified front when it comes to fintech.

The nature of Southeast Asia as a region means we will see more national fintech champions. At the same time, regional superapps can emerge but will likely be fintech platforms focused on a specific set of customers or consumer superapps with fintech channels in various markets.

Paulo Joquiño is a writer and content producer for tech companies, and co-author of the book Navigating ASEANnovation. He is currently Editor of Insignia Business Review, the official publication of Insignia Ventures Partners, and senior content strategist for the venture capital firm, where he started right after graduation. As a university student, he took up multiple work opportunities in content and marketing for startups in Asia. These included interning as an associate at G3 Partners, a Seoul-based marketing agency for tech startups, running tech community engagements at coworking space and business community, ASPACE Philippines, and interning at workspace marketplace FlySpaces. He graduated with a BS Management Engineering at Ateneo de Manila University in 2019.