November 2020 opened with a historic week for both ends of the Pacific. On one hand, you have the end of the US Presidential Elections, marked by the announcement of the new President-Elect, Joe Biden. On the other, you have the Ant Group’s IPO — pegged to be the biggest in history — halted by Chinese authorities, as they called in company leadership to Beijing.

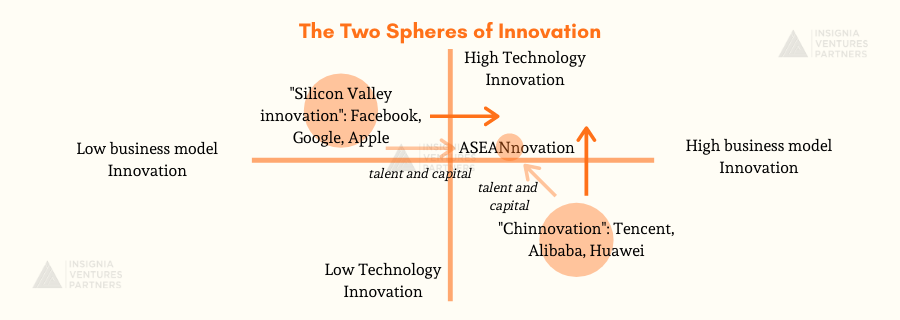

These two events mark significant milestones in the longer narrative of global innovation defined by the emergence of two spheres of influence over the past half-century. On the one hand, you have the US’s technology-driven innovation, beginning with the silicon chip and the internet which has led to the likes of Google and Apple dominating most of the world’s everyday experience of technology.

On the other, you have China with its brand of innovation and entrepreneurship producing highly scalable and retentive business models, like the super-app or social commerce. Companies like Alibaba and Tencent with their ecosystem growth trajectories have reinvented the way tech companies reach billions of people with speed.

Confluence and Bifurcation

And over time these two spheres have found common ground. One significant shared area of interest has been Southeast Asia. And from the perspective of Southeast Asia, the confluence of these two spheres of innovation has significantly influenced the way local startups have formed.

For example, you have many local founders who grew their tech careers in the US gaining inspiration and ideas from the latest technological innovation. Then coming home, they take a page out of the China playbook when it comes to distribution and scale. The many permutations of the interaction between these two spheres have resulted in a net positive influence, with Southeast Asia innovation benefitting from the best of both worlds.

From the perspective of Southeast Asia, the confluence of these two spheres of innovation has significantly influenced the way local startups have formed.

Just as these spheres have interacted to shape innovation beyond their own shores, more recently we’ve seen the bifurcation of these two spheres. Catalyzed by political differences, trade policies, and more recently data privacy regulations, we’ve seen how the bifurcation of these two spheres has made it challenging, if not outright impossible, for tech companies on either side of the Pacific to cross over.

To adapt to this bifurcation, many of the poster boys of these markets have been innovating either their technology assets or business models in order to gain a competitive advantage over their peers across the Pacific. For example, Facebook is evolving its business beyond social media to gain a foothold into ecommerce and video, similar to the WeChat super-app model. Over in China, Huawei has been developing its own chip technology.

Illustrating the two spheres of innovation

Role of Southeast Asia in global innovation

As a new chapter opens in US politics that bodes a hopeful future for global cooperation, and China’s regulation evolves with the growth of its innovation poster boys, Southeast Asia’s role as a melting pot for these two spheres of innovation becomes more important than ever.

Interestingly, just as the confluence of these approaches to innovation reaped benefits for Southeast Asia, so has its bifurcation. There’s the diversification of supply chains towards the global south, and greater inflow of liquidity, talent, and infrastructure into the region from China and the US.

This is especially the case in Singapore, where you have Bytedance, Tencent, and Alibaba as well as Google and Facebook setting up their Asia hubs in the city-state. You have fast-growing markets like Indonesia and Vietnam becoming investment destinations and talent hotspots for these same companies.

Southeast Asia’s role as a melting pot for these two spheres of innovation becomes more important than ever.

Joe Biden’s acceptance speech rang with a message of unity for the people in his country — a future which Southeast Asia also offers for innovation across the Pacific. And as investors in this innovation, the upside potential is huge for us to work with both spheres in riding the wave of the region’s emerging technology markets. And in order to do that, we can’t just build good companies — we need to build great companies.

To that end, over the past year, our resident content strategist Paulo and I put together the best stories and insights from our team, our founders, and fellow investors on what it takes to build great companies that stand the test of time in the region: “Navigating ASEANnovation: The Reservoir Principle and other essays on startups and innovation in Southeast Asia”. It’s now fresh-off-the-press and available for pre-order on Amazon.

If you know an unstoppable founder who’s contributions to ASEANnovation should not be missed, reach out on Linkedin or Twitter and get the chance to get a free copy of the book!

Yinglan founded Insignia Ventures Partners in 2017. Insignia Ventures Partners is an early-stage technology venture fund focusing on Southeast Asia and manages more than US$350 million from sovereign wealth funds, foundations, university endowments and renowned family offices. Insignia Ventures Partners is the recipient of two back-to-back “VC Deal of Year” awards for Payfazz (2019) and Carro (2018) from the Singapore Venture Capital and Private Equity Association and its portfolio include many other technology leaders in Southeast Asia. He also co-hosts the On Call with Insignia Ventures podcast, where he chats with portfolio founders and regional investors. An author on venture capital, startups and innovation, he recently published his fourth book, Navigating ASEANnovation (World Scientific, 2020). He also serves on the International Board of Stars – Leaders of the Next Generation, the Singapore Government’s Pro Enterprise Panel and is a Board Member at Hwa Chong Institution.