At the HKVCA Asia Venture Capital Forum (AVCF), Yinglan joined a panel featuring Asia Alternatives’s Praneet Garg, Betatron Venture Group’s Matthias Knobloch, and Jungle Ventures’ Amit Anand, and moderated by BlackRock Private Equity Partners’s Yan Yang.

The panel covered Southeast Asia, specifically what makes the region’s diverse markets and industries attractive and compelling to global investors today, compared to years before and other VC/PE markets.

We also share our own thoughts on the topic in this article.

(1) In a world of rising costs, solutions are emerging to lower the costs of innovation and digital transformation.

In particular, a lot more businesses are lowering the costs of innovation and growth for organizations — whether that’s generative AI transformation, improving supply chain efficiency, being able to sell more products to other countries — this layer of enablers are important as Southeast Asia reaches a point of maturity in its innovation ecosystem where the opportunities available has outpaced the ability to invest in these opportunities.

A pertinent example is the rise of TikTok in the region, in particular its ecommerce business — many sellers and brands know its value and importance but have either been able to sustainably crack this platform or diversify out of it. Companies like Konvy and Shipper are supporting businesses in this regard through different means.

Another example is where you have companies developing infrastructure to reduce the costs of building and deploying financial services, like Fazz with their infrastructure for digital asset transactions (StraitsX) or their infrastructure for rural Indonesia’s financial services (see this article on Fazz Agen), or Brankas with their open finance API suite.

(2) Amidst lower barriers to market for technology companies, there is more incentive to develop differentiation in operational moats and use cases out of the region.

Innovation is trending towards being much more verticalized, requiring an even deeper industry understanding than ever before from investors exploring such opportunities, specifically what segments of value chains are ripe for a Southeast Asia business, given existing competition and commercial opportunities.

Take generative AI for example, where it may not be practical to occupy the model layer with the likes of Open AI, Copilot, etc., but businesses from Southeast Asia tackling the middleware layer (enabling other businesses to tap into the model layer or make a Gen AI transformation) or application layer may be more interesting (see more on our AI exploration).

(3) Amidst geopolitical tensions, Southeast Asia is opening up opportunities to sell globally.

Innovation is trending towards more localization, within the context of geopolitical tensions (US-China), where you have more opportunities for homegrown companies from Southeast Asia to sell globally, whether its mental healthcare services (see this article on Intellect) or even semiconductors (from Malaysia).

(4) Amidst increasing competition, Southeast Asia offers a critical mass of diversifying growth trajectories.

Southeast Asia is uncovering a “critical mass of growth trajectories”, thanks to increasing cross-pollination interest from across the world, from the US to China to MENA, etc.

Depending on the business, you could be investing in a company that is massive enough tackling the Indonesian market, or a company from Singapore that is pan-Asian (see this article on Carro) or even global or a company that started out in Southeast Asia and have since expanded to other emerging markets in Latin America or even the Middle East (see our discussion with Brankas CEO Todd Schweitzer on this).

Global investors are in the best position to help companies chart out these trajectories and widen their horizons in the markets right for their business. From a portfolio perspective, the multiplicity of growth trajectories coming out of the region offers diversity.

(5) Amidst the higher cost of expansion, Southeast Asia entrepreneurs are better suited to expand globally.

Southeast Asia entrepreneurs, especially those who have had experience successfully growing a business across two or three markets in its first few years, also gain this “expansion experience arbitrage” given how challenging it can be to expand even a technology business across the region’s markets, competing not only with peers but also much larger competitors. It adds more depth to the merits of being a second-time or seasoned entrepreneur as well.

Global investors are incentivized to partner with entrepreneurs and businesses that have built the maturity it takes to move across markets, regardless of the approach.

When orchestrated in the right way, companies with pan-ASEAN organizations can fully leverage the benefits of the region’s rapidly emerging tech talent class and relatively lower cost barriers to start a company (compared to more mature, saturated markets).

New Narrative for Southeast Asia startups

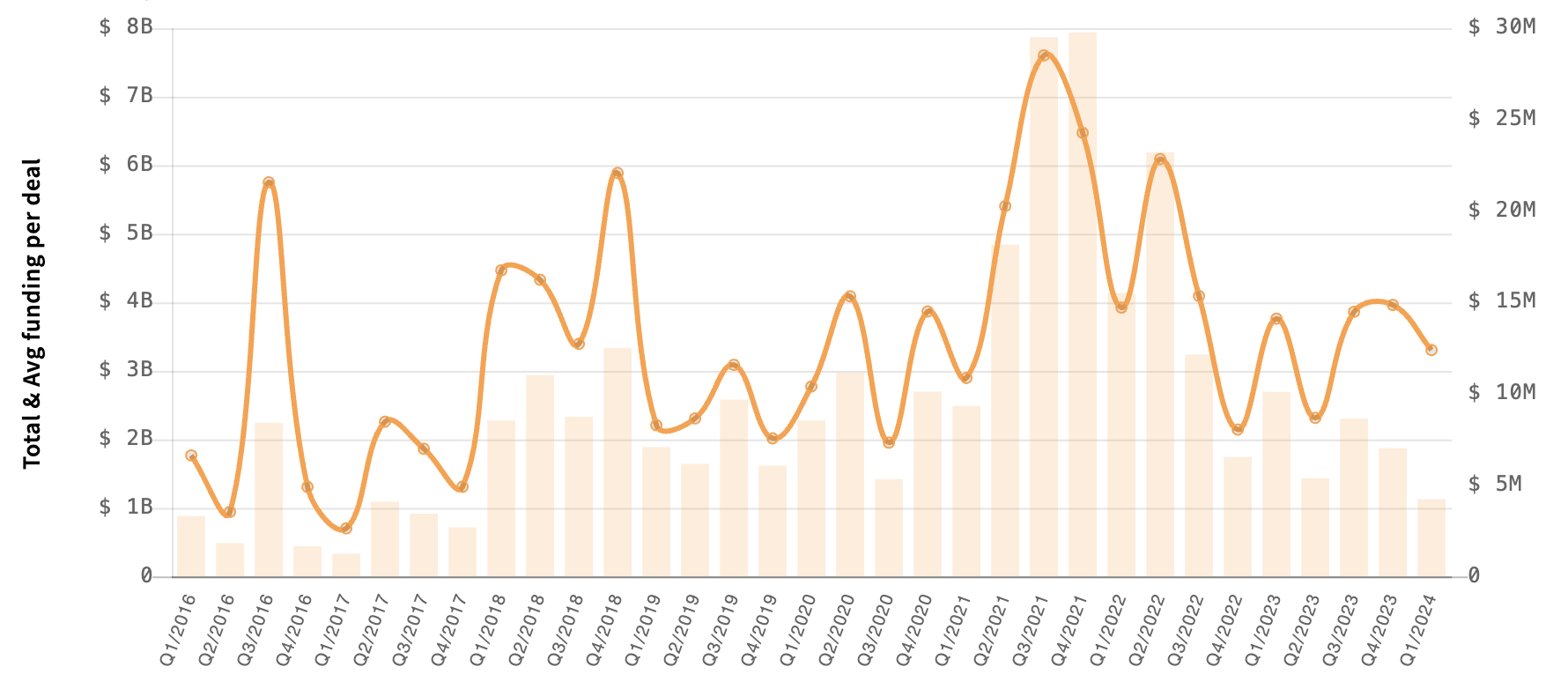

As funding rebounds to roughly 2019 levels, though not quite at 2018 and still far from the hype of 2021, it is important to note that the nature of what has attracted global investors to Southeast Asia has evolved. The biggest shift going in today’s market is that before the focus has revolved around finding opportunities in Southeast Asia itself as a region of emerging markets. While that remains relevant today, there is a new class of interest in Southeast Asian companies that can become pan-Asian or global outcomes, with the confluence of talent, capital, and even competition in the region driving this maturity. These wider horizons for SEA companies naturally makes outcomes from the region more significant.

Paulo Joquiño is a writer and content producer for tech companies, and co-author of the book Navigating ASEANnovation. He is currently Editor of Insignia Business Review, the official publication of Insignia Ventures Partners, and senior content strategist for the venture capital firm, where he started right after graduation. As a university student, he took up multiple work opportunities in content and marketing for startups in Asia. These included interning as an associate at G3 Partners, a Seoul-based marketing agency for tech startups, running tech community engagements at coworking space and business community, ASPACE Philippines, and interning at workspace marketplace FlySpaces. He graduated with a BS Management Engineering at Ateneo de Manila University in 2019.