The latest U.S. tariffs on Chinese imports aren’t just a China problem—they are reshaping tech startups, supply chains, and corporate investment strategies across Asia.

With a 10% tariff already in place and a proposed 60% tariff on Chinese goods, startups and corporates must adapt fast or risk falling behind. From rising production costs to new regional winners, this is a moment of both disruption and opportunity.

To navigate this shift, we developed the T.A.R.I.F. Framework to break down how startups can assess and respond to these changes effectively.

The T.A.R.I.F. Framework for Startups

1️⃣ Trade & Supply Chain Resilience (T) → Where will your product be made next?

📌 Tariffs are pushing companies to relocate manufacturing beyond China to Vietnam, Malaysia, and Thailand—but at what cost?

- ✅ Short-term disruptions from relocating supply chains

- ✅ Higher logistics costs as companies rebuild supplier relationships

- ✅ Potential regulatory barriers in new manufacturing hubs

Startup Playbook:

- ✔ Diversify suppliers to avoid over-reliance on one country

- ✔ Strengthen regional partnerships for agility

- ✔ Explore nearshoring options (e.g., Taiwan firms moving to Mexico for U.S. market access)

2️⃣ Adversarial Retaliation & Regulatory Scrutiny (A) → Will you get caught in the trade war?

📌 China is responding to tariffs with antitrust probes into U.S. tech giants (Google, Nvidia, Intel). If your business has ties to these companies, expect greater compliance risks.

- ✅ Cross-border tech companies face stricter regulations

- ✅ Market access may tighten for U.S.-affiliated startups

- ✅ Companies may need to operate with dual-track business models (one for China, one for the U.S.)

Startup Playbook:

- ✔ Monitor regulatory shifts to anticipate risks early

- ✔ Build localized business strategies to comply with jurisdiction-specific tech laws

- ✔ Develop data governance policies to navigate regulatory tensions

3️⃣ Regional Trade & Economic Shifts (R) → Who are the new winners?

📌 Vietnam’s booming trade surplus with the U.S. makes it an attractive market—but could also lead to future tariffs.

- ✅ India, Indonesia, and the Philippines are emerging as new investment hotspots

- ✅ Regional trade agreements (RCEP, CPTPP) are unlocking cross-border growth opportunities

Startup Playbook:

- ✔ Identify new expansion markets based on shifting trade flows

- ✔ Leverage government incentives for setting up operations in emerging tech hubs

- ✔ Partner with corporates & MNCs to accelerate entry into new markets

4️⃣ Investment & Capital Market Impact (I) → Where is the money flowing?

📌 Investors are re-evaluating risks, favoring startups with de-risked supply chains and global expansion strategies.

- ✅ M&A activity is rising as corporates look to consolidate supply chains

- ✅ IPO strategies are shifting → More SEA startups exploring other options beyond Wall Street

- ✅ Sovereign wealth funds & corporate VCs are stepping in to fill funding gaps

Startup Playbook:

- ✔ Communicate supply chain resilience to investors

- ✔ Position for M&A & strategic partnerships as corporates consolidate

- ✔ Explore alternative funding sources (corporate investors, sovereign wealth funds)

5️⃣ Final Consumer Impact & Pricing Strategies (F) → Will your customers pay more?

📌 Higher production costs could lead to 26%-46% price hikes on tech products, slowing demand.

- ✅ Cost-conscious markets (SEA markets, India) may favor budget-friendly alternatives

- ✅ Localized pricing & product adaptation will be essential for customer retention

Startup Playbook:

- ✔ Optimize pricing models (subscriptions, pay-as-you-go, dynamic pricing)

- ✔ Offer regional versions of products with cost-efficient adaptations

- ✔ Focus on value-driven messaging to justify price adjustments

Takeaways for Corporates Looking to Partner or Acquire Startups

The tariff-driven shifts in Asia aren’t just a startup problem—they’re an M&A and partnership opportunity for corporates.

📌 Corporates need to align with startups that can help them:

- ✅ Localize supply chains and reduce dependence on China

- ✅ Expand into fast-growing, tariff-favored markets

- ✅ Leverage AI & automation to offset rising costs

💡 3 Key Corporate Strategies:

🔸 M&A for Supply Chain Resilience

- ✔ Acquire startups that localize production & digitize logistics

- ✔ Focus on companies that enhance efficiency through AI & automation

🔸 Invest in Regional Expansion & Market Leaders

- ✔ Target startups expanding into SEA, India, MENA

- ✔ Prioritize companies with proven regulatory adaptability

🔸 Partner with AI-Driven Cost Optimization Solutions

- ✔ Work with AI startups that reduce operational costs

- ✔ Invest in fintech enablers simplifying cross-border payments

The Big Picture 🌏

The U.S.-China trade war is reshaping global tech, and Asia is at the center of this transformation. The startups and corporates that adapt, diversify, and partner wisely will turn uncertainty into opportunity.

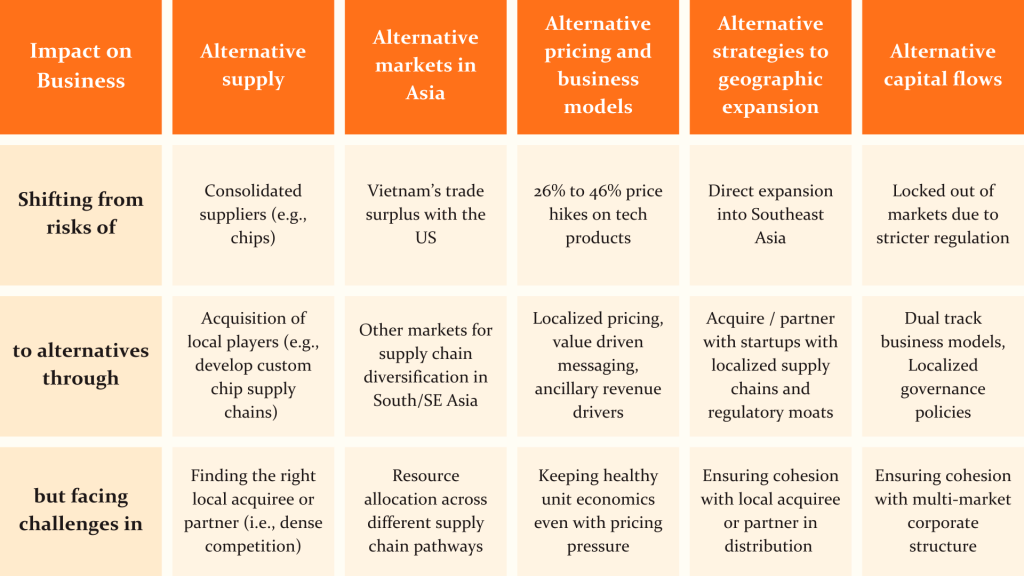

We live in an age of finding alternatives, that includes adapting to new tariff regimes from the US and retaliation from China.