One of the big trends of the pandemic digitalization wave was the increase in enterprise adoption of digital-first solutions across a variety of functions, from financial management to healthcare for employees.

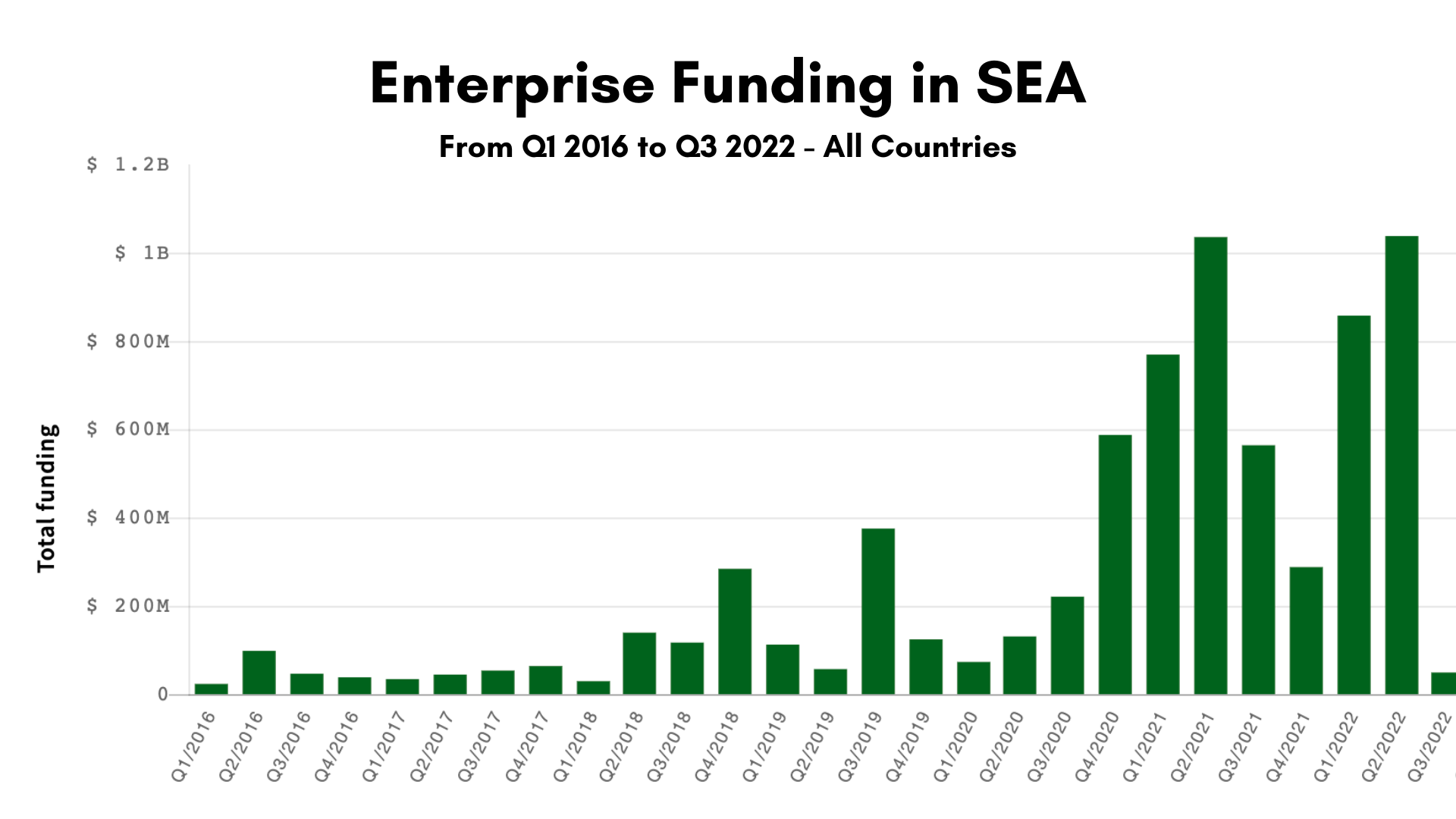

This cascaded into a massive increase in funding for platforms serving enterprise, with private funding in Southeast Asia’s enterprise sector in 2021 surpassing US$2B (vs being less than a billion in 2020) and in 2022 H1 surpassing US$1B. (Taken from our market statistics tool)

But as enterprises face a post-pandemic, inflationary environment with pressures on costs and shifts in priorities, how are enterprise tech platforms in Southeast Asia sustaining gains? Or does the current landscape actually pose more opportunities?

In this article we try to answer these questions, framing the ingredients for the continued momentum of enterprise innovation post-pandemic into 3Ms:

- Must-Have Value Propositions are needed to sell amidst tightening budgets for enterprises.

- Maturity of Market / Industry is needed to pull in mass and laggard adoption long-term, as well as set standards or regulations throughout the industry.

- Monetization at Scale is needed for platforms to sustain and grow gains from the pandemic-induced enterprise digitalization wave. Platforms able to achieve this will have significant dents in the texture of the competitive landscape for enterprise wallets.

Must-Have Value Proposition (MVP)

The ability of enterprise tech platforms to develop this MVP is being driven by several factors, three of which we discuss below:

(1) First is the COVID-induced paradigm shift in end-consumer behavior and blurring lines in the competitive landscape → must-have to keep up with the rest of the industry

As Brankas CEO and co-founder Todd Schweitzer illustrates when it comes to banks looking at open finance APIs amidst increasing competition from tech companies and shifts in the way target populations are banking: “Emerging from COVID, I’ve been just incredibly excited by seeing traditional banks that are really starting to think about API products as a new product category and as a new revenue driver where they can change the economics of reaching their [target] populations, and reaching particularly consumers and SMEs in a different way…And also there’s a bit of a real threat from the likes of the Go-Jek, Grab, Dana, and GCash in the Philippines that are actually taking market share from the consumer banking side.”

(2) Second is the scale of the core product / service of the platform (breadth showing it can cater to a variety of circumstances) and the availability of proof-of-ROI for customers (depth showing that there are meaningful benefits to adoption without which the customer would be worse off) → must-have to avoid falling back into status quo issues and inefficiencies

Intellect CEO and founder Theodoric Chew illustrates how serving the mental healthcare needs of enterprise clients might happen with their localized offerings, which go beyond app translation to actually have a network of providers and professionals for various markets: “Say a client of ours has an employee in China, for example, they open the app and they get a whole app in Mandarin. They get local native mental professionals that are native Chinese speaking as well, and we do the same across the region.”

He also shares how their efforts to prove ROI through studies done by their clinical team with institutions tie into the shift in perception of employment is about more than just salaries: “One of the key things we’re doing now is to prove ROI as well — how do mental benefits and productive mental support lead to less attrition and fundamentally how do these long-term health benefits lead to a reduction in chronic health issues?… Fundamentally it’s no longer just putting in the work and getting a paycheck. It’s a lot of times the benefits, the coverage, and the support they get from their employers, which is a big part of their lives.”

Hear from Intellect’s Clinical Director in this interview

Brankas CEO Todd also breaks down how the Brankas’ offering tackles the opportunities of growth for various types of clients, from consumer lenders to payment processors to banks: “We work with a few of the largest consumer lenders, whether it’s BNPL or e-commerce merchant financing so that they can make instant credit decisions…We also are enabling payment processors and e-commerce shops to accept direct pay-by-bank, which will be 80, 90% cheaper than running through a payment intermediary…we’ve enabled [banks] to actually open up a new channel and a new product category where they can now onboard customers or they can enable pay by bank products, without needing to build new software.”

(3) The third driver is the challenges of labor shortages (especially when juxtaposed with the scale of demand) and labor costs as a result, vis-a-vis the consistency and cost-efficiency that can be provided by enterprise technologies. → must-have to avoid labor challenges and inefficiencies

WIZ.AI co-founder and chairman Jianfeng Lu shares how the consistency and compliance of their conversational AI talkbots designed for customer calls have been helping to meet the shortage of labor (at this level of quality) for these tasks even beyond the pandemic: “…after the pandemic, we saw a kind of a labor shortage across the world, not just in the US, but also like here in Southeast Asia. Although we have a large population here, a lot of businesses, they still found a big shortage for that…our bot is also able to help to scale into a very large volume…it is very consistent and fully compliant…”

Jianfeng shares one specific example of their talkbots in action — debt collection: “Previously, those lending vendors usually hired thousands of people to make phone calls to do debt collection. But one of the customers did it without any human agent being hired because recruiting, training, quality control and human agent retention is a very tedious job and it’s very, very hard to find those talents… So they set up the standards, then later they use our bots to help them to do the phone call…For this task, they actually significantly reduced the cost and also increased productivity.”

Maturity of Market / Industry

Apart from building up must-have value propositions to sell innovation in an environment where wallets are tighter, another way to maintain if not grow the momentum of enterprise innovation in Southeast Asia has been to mature the target market or industry of the platform.

A commonality across many enterprise players based out of the region is that they are tackling market opportunities that are nascent in emerging markets or Southeast Asia specifically. This has put these platforms in prime position to better serve these markets than say platforms that originate from more developed markets (assuming the former can move fast enough).

There are two ways we see enterprise tech platforms maturing the industries they are in:

(1) The maturity of nascent industries happens through deep stakeholder involvement (and thus education).

Brankas CEO Todd shares the example of how they work closely with financial institutions and banks: “By choosing to enter a not yet regulated and relatively new market in a regulated industry, there’s a lot of education…We work with financial institutions as an enterprise SaaS provider and help them become API publishers…for the banks, it’s showing them the use case and the commercial value, and actually in some cases, literally working with their team to build the business case so that they can get board approval or management approval.”

(2) The maturity of nascent industries happens by solving the right problems in the right order.

This especially applies to mental health, which Intellect CEO Theo explains: “We took the reverse approach to what the US players did. They went clinical and then upstream to light touch care, while we went light to touch care to get people started and already went much deeper in the care we give. So it started from self-care programs moved to coaching, clinical therapy, and we do offer psychiatry and even a 24/7 distress support piece as well…The learning was around how to build a best-in-class mental health care system. That has never been done in Asia, but what we did next was how do we make sure that we’re solving the right issues in Asia. Naturally, there are very different problems and we tackle them differently as well.”

Another example is how Shipper evolved as a platform by growing its capabilities with its initial customer SMEs and eventually began serving enterprise customers as well. Shipper COO and co-founder Budi Handoko lines up the distinction between serving small businesses and enterprise with digital-first logistics solutions:

“Small businesses and large businesses have different problems. For small businesses, their problem is actually, how do they scale up. How do they make sure that they actually focus on the marketing, focus on the sales or add new products without worrying about the logistics piece?

Meanwhile, for the larger businesses, all they want is efficiency. They start looking into efficiency. They start looking into data integrity. They start looking into real SLA. They start looking into the satisfaction of the customer as well. So we’ve worked with different larger businesses…And the metrics that we are talking about are different from the smaller sellers. And a lot of those are mostly just because they’re different business scales.

So I think besides serving these small to medium enterprises, we also serve the larger customers which require warehousing. These businesses also have two kinds of businesses: ecommerce fulfillment, which is normal traditional ecommerce, but they also have their other fulfillment, which is a B2B business. So that is also another sector where we add value to our customers, so that they actually don’t need to rent big, full warehouses for their B2B businesses. They can run a small portion at our shared warehouse, but they can still run their B2B businesses, while using our service too.”

Monetization at Scale

Finally, in order to thrive post-pandemic, enterprise platforms, especially those that benefited from the digitalization bonus, are hard-pressed to scale monetization and create flexibility in their business models.

(1) For some cases like unlocking the open finance opportunity in Southeast asia, this means making product development tradeoffs in terms of localization in order to expand as a global emerging markets company.

Brankas CEO Todd explains: “We saw a regional opportunity. We did not want to get sucked into too much localization because we see our opportunity to expand as a global emerging markets company. So our regional expansion required a lot of product development tradeoffs to ensure that we had something that was geo-agnostic, but really focused on solving emerging market infrastructure.”

Verihubs CTO and co-founder Williem Williem illustrates how this approach of building for scale applies on a product level: “It’s one of the lessons that we have learned during building Verihubs, because sometimes clients want solutions tailored for them. And we are trying to build the general versions of the customer’s needs, because sometimes when customers request something, they don’t really know how to use it. They don’t really learn how to maximize the power of these AI technologies.

And instead of relying on the customer needs, we are trying to talk with the customers and give some kind of explanation to them that our generic versions of the solutions are the best ones for them to integrate because they don’t really need to spend more resources on user experience testing or something because the solution that we have has been tested, has been researched by our team to provide the maximum capability.”

(2) In other cases, selling to enterprise is the obvious choice for monetization given how nascent the industry is, and specifically the spending of the end-consumers around the given product or service.

Intellect CEO Theo shares the thought process behind their enterprise strategy: “We found that actually who was really the one paying at scale would not be the consumers at least today…So we looked at employers. There was a huge segment that actually paid for it, and we looked at insurers as well, and the related health benefits players…our goal is to work with the largest employers and the largest insurers…So that means we really have to take a regional [focus] from day one.”

This thought process is shared across healthcare platforms, as women’s healthtech platform co-founder Rio Hoe explains: “There are a lot of employers can do in order to provide women with the tools, support network, and access to services. They can go a really long way in making them feel more supported, more engaged, and lead healthier and better lives. And we want to be part of that.”

Operating in nascent industries or selling technologies that require a learning curve of the market mean the platform is likely to find it more valuable to sell first to the big wallets. Verihubs CEO Rick Firnando explains why they went for big banks first: “I think the biggest challenge we’ve faced was during the first time we launched the product, and the biggest challenge was building trust. It’s not only happened to us but also to many other software-as-a-service companies in the B2B landscape. And getting your first customer is really hard.

The way we tackle these challenges was we made sure our product solves our customer’s problems. This is the first one, and we really paid attention to our product reliability because [we’re] in B2B market sales; your product has to be reliable. And the last one was getting their credibility, which is why we dealt with banks and fintechs in the first place. Having big banks as our customers definitely will help us to get more customers because everyone knows earning trust from banks is not that easy.”

(3) And finally, scaling monetization is also an operational effort. This means enterprise tech platforms need to be able to mature their sales processes, infrastructure, and even mindset.

Brankas CEO Todd illustrates his own learning curve venturing into enterprise sales: “In terms of learnings, I think I was naive to enterprise sales and when you’re convincing a financial institution or a large tech company to basically buy an embedded finance or open finance product for the first time, it is very easy and tempting to get sucked into an endless POC proof of concept or some pilot initiative, which actually does not have support to become a long term kind of multi-hundred thousand or million dollar account value.

So I don’t think we were discerning enough and I don’t think we had the right kind of enterprise sales infrastructure — everything from pre-sales solutioning to post-sales implementation — to really support that.

So I think my big lesson was for those entering into an enterprise business, do not underestimate the complexity of the sales process, which again, as I say that, sounds like an obvious thing, but it’s very easy as an early-stage founder to get excited by people with a business card from a large institution saying they want to work with you on a POC. But I think finding that focus is actually essential in enterprise.”

Read more about enterprise and B2B sales learnings from founders across markets and industries

Insights from Todd, Theo, and Jianfeng taken from this podcast episode on enterprise tech:

Paulo Joquiño is a writer and content producer for tech companies, and co-author of the book Navigating ASEANnovation. He is currently Editor of Insignia Business Review, the official publication of Insignia Ventures Partners, and senior content strategist for the venture capital firm, where he started right after graduation. As a university student, he took up multiple work opportunities in content and marketing for startups in Asia. These included interning as an associate at G3 Partners, a Seoul-based marketing agency for tech startups, running tech community engagements at coworking space and business community, ASPACE Philippines, and interning at workspace marketplace FlySpaces. He graduated with a BS Management Engineering at Ateneo de Manila University in 2019.