The AI industry is rapidly expanding in several directions: (1) localized AI races to develop models to rival the GPT’s of the world (see China) or build apps attuned to the needs of specific markets, (2) investments into infrastructure and talent developments through private-public partnerships (see NVIDIA and Singapore, Microsoft and Indonesia, etc.), and (3) greater influx in funding from private debt and equity (worth noting the increasing attention being paid to private debt as an option in today’s high interest rate environment vis-a-vis the costs of scaling generative AI solutions).

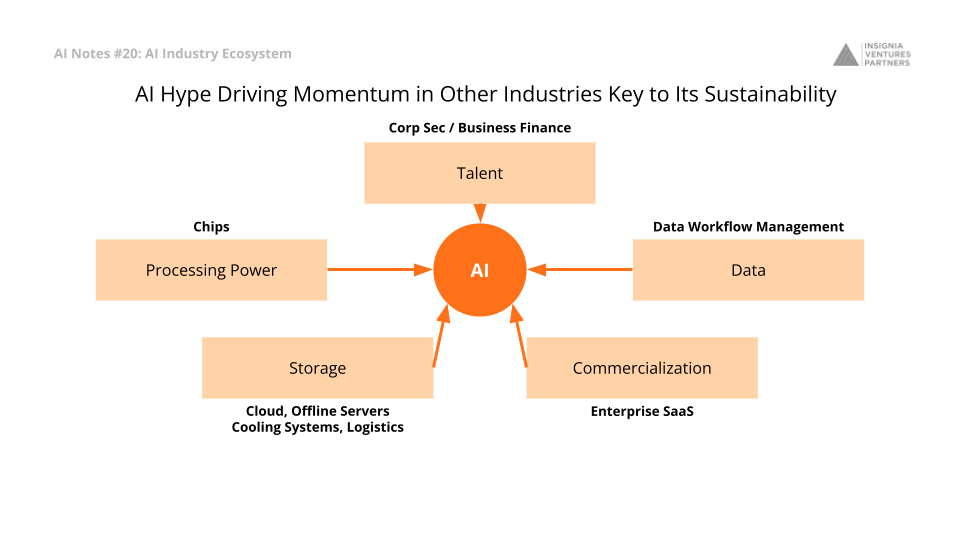

Given the speed with which resources are being pooled and utilized in AI solution development, it’s important to note that AI as an industry can not be sustainable without the parallel growth of adjacent industries as well, which we tackle in this latest AI Notes.

(1) Cooling technologies enabling sustainable server and data centre development across the region.

Cooling technologies will be key industry to watch especially as servers and data centers are being set up across Southeast Asia by global players (for example, see Microsoft’s 2.2B investment into Malaysia, and 1.7B investment into Indonesia, with Thailand housing the company’s first regional data centre.

In 2023, the production value of AI servers already exceeded 50% of the total global server market, a significant indicator that the infrastructure around server maintenance also needs to keep up, especially in markets where servers have to deal with power hungry chips and hot climates.

(2) AI chip supply chain impacting costs and funding spend.

Next generation AI chips being produced (e.g., NVIDIA’s Blackwell B200 GPU or Apple’s M4 chipsets) will shift supply-demand dynamics for AI companies as they race to own or gain access to the processing power of these AI chips. There may be an opportunity for platforms to take advantage of the arbitrage between supply and demand, but this will likely only generate short-term value.

Long-term disruptive opportunity is in driving down costs of AI chips or enabling companies to build their own AI chips in-house. The ability of gen AI companies to access these chips, especially those facilitating high processing demand activities, will be a key driver for competitive scale, and thus a significant cost center for fundraising.

(3) Business finance and corporate secretary providers to drive entrepreneurial talent flows.

If (1) and (2) cover the infrastructure necessary for AI models to run, it’s also important to consider the industries enabling talent to develop a wider pool of AI companies. Among these is the corporate secretary and business finance industry that offer services for foreign entrepreneurs to settle in markets like Singapore and build companies headquartered in the country.

This builds on a trend we have followed in the last five years of Chinese entrepreneurs looking to incubate companies outside of China from day one, as opposed to simply expanding from China. Among such entrepreneurs and companies, AI is a large focus for them.

(4) Data processing automation to speed up AI use case development.

Data processing automation is another key industry for AI adoption, specifically for more commercial opportunities to emerge. We’ve written in the past about the value for enterprise to be able to develop their own in-house models to secure the data they operate with, and having the ability to process large amounts of data from various sources (including offline paper documents) can make or break an organization’s ability to unlock the potential of AI. Bluesheets has supported businesses from various industries in such data transformation, especially in the insurance industry.

(5) Enterprise SaaS driving commercial opportunity for AI.

While Enterprise SaaS is a fast growing industry in Southeast Asia with the digital transformation wave maturing across the region (revenues expected to nearly double in the next four years), it is also still comparatively nascent compared to the rest of the world (and this is an important point given how the enterprise SaaS competitive landscape is inevitably global at scale).

But with the emergence of AI and generative AI solutions to rival traditional solutions, the industry presents an opportunity for SaaS companies to develop more localized and competitive AI solutions in Asia.

This means the scalability of early AI companies in the region like Appier, WIZ.AI, Verihubs, Nektar.ai, among others, will be important in laying down the playbook and proof for further adoption and a more mature competitive landscape.

Paulo Joquiño is a writer and content producer for tech companies, and co-author of the book Navigating ASEANnovation. He is currently Editor of Insignia Business Review, the official publication of Insignia Ventures Partners, and senior content strategist for the venture capital firm, where he started right after graduation. As a university student, he took up multiple work opportunities in content and marketing for startups in Asia. These included interning as an associate at G3 Partners, a Seoul-based marketing agency for tech startups, running tech community engagements at coworking space and business community, ASPACE Philippines, and interning at workspace marketplace FlySpaces. He graduated with a BS Management Engineering at Ateneo de Manila University in 2019.