Highlights

- Where is the wealth coming from? This latest exodus is not so much made up of Chinese venture capitalists or venture capital firms…but of Chinese families with various ties to China’s internet and tech boom.

- A billion-dollar industry in the making? A hybrid between private banks and venture capital to manage family wealth from China poses a new opportunity to best support this gold rush into Singapore.

- Where is the wealth going? Given how much of this wealth was created (building tech companies) and the nature of the destination region’s growth (again, tech companies) it comes to no surprise that this capital is also looking for similarly tech-focused or venture-backed business targets.

Singapore has long been an attractive destination for wealth, and the families behind this wealth, with the country’s low-tax regimes, relatively stable economy, free-market credentials, and high standard of living, a position which has only strengthened with their rapid and effective response to the pandemic over the past year.

The city-state has not only become a destination, but also a gateway for the wealthy to access the fast-emerging markets of the global south. This is especially the case for a relatively new generation of rich Chinese families and tech billionaires seeking greener pastures from which to manage and invest their wealth — wealth that was largely built over the course of China’s internet and tech boom over the past two decades.

Parting of the seas for Chinese wealth into Singapore

With Southeast Asia’s exciting macroeconomics and the rise of venture-backed tech companies, the region has become exactly these greener pastures Chinese wealth has been searching for. Apart from the strengthening pull of Southeast Asia, some of this wealth has also been finding exposure to its neighbor India, which has been increasingly more difficult to do directly from China with more stringent regulations around private equity investments — something tech giant Tencent was able to go around recently with a debt investment into ShareChat.

And Singapore has become the hub from which to tap into these lucrative investment opportunities not just in Southeast Asia but in India and other markets that would have been more difficult to tap into from China.

But the pull of investment opportunities in Southeast Asia and India is just half the story. The pace at which Chinese wealth has been seeking footing in Singapore has not always been this way. The evolving political instability in Hong Kong and the antitrust moves against the likes of Alibaba and Tencent have accelerated the exodus, incentivizing many to find opportunities abroad.

With Southeast Asia’s exciting macroeconomics and the rise of venture-backed tech companies, the region has become exactly these greener pastures Chinese wealth has been searching for.

The unlikely frontline of the exodus

Interestingly enough, this exodus is not so much made up of Chinese venture capitalists or venture capital firms, whom one would think would be leading the charge in a region where venture-backed tech companies are getting mega-rounds and going highly valued in the public markets. The wealth exodus has been led largely by Chinese families with various ties to China’s internet and tech boom.

They range from the likes of the family behind hotpot empire Haidilao with their US$77 billion fund, which has heavily invested in technology, to former tech founders turned billionaires like Meituan Dianping’s Zhang Tao (whom we’ve spoken to on our podcast) and Tencent’s Tony Zhang. They have not only found in Singapore an avenue for wealth creation, but also a place to live and settle down. Specifically for Chinese wealth, the combined ability to still access China markets and at the same time easily deploy capital to the global south from Singapore make the market an ideal headquarters for family offices to set up shop.

Then apart from being able to manage wealth from Singapore, there’s also the allure of becoming a citizen that has attracted many of these Chinese families and HNWIs. There’s not only the standard of living to consider but also the power of the Singapore passport and the ability this citizenship grants to invest across various geographies.

And Singapore welcomes this capital influx and the talent and expertise behind this capital. With all the country’s initiatives to bring capital over the past ten years in both the private and public markets, this influx of Chinese wealth is a free ticket to leverage not just the investments but also the innovative minds behind the capital.

The wealth exodus has been led largely by Chinese families with various ties to China’s internet and tech boom.

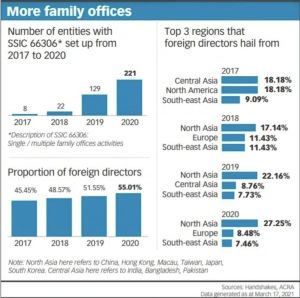

More family offices coming into Asia, with directors coming from all over the world. Taken from Illumine Advisory: https://illumineadvisory.com/investment-landscape/f/sgp-sees-jump-in-family-offices-as-asias-ultra-rich-set-up

A billion-dollar industry in the making?

Given how raw and (relatively) recent much of this wealth moving into Singapore was made, the gold rush has opened up a demand for wealth management services. The number of asset managers coming from China following the gold rush has increased massively in recent years. Singapore is home to 400 single-family offices as of end 2020, according to the Monetary Authority of Singapore (MAS), doubling from 2019. DBS Private Bank’s family office saw their customer base from Greater China increase up to 20%, from 25-30% in 2018 to around 45%.

And Chinese family offices and HNWIs are also no stranger to being limited partners in Singapore venture capital funds. The only difference is that they are making the move to the city-state and for many of them, looking to institutionalize their wealth management. The VCC structure in Singapore also makes it easier for local family offices to invest in early-stage startups.

A hybrid between private banks and venture capital to manage family wealth from China poses a new opportunity to best support this gold rush into Singapore, not just for the asset managers themselves but the Singapore economy and the potential investment opportunities this capital can be directed to, from tech startups to crypto-assets across the region. Tapping into these various needs is an industry of potentially tens of billions of dollars in the making, considering how the wealth coming into Singapore is global.

Tapping into these various needs is an industry of potentially tens of billions of dollars in the making, considering how the wealth coming into Singapore is global.

Snapshot of family offices needs and challenges. Taken from Straits Times: https://www.straitstimes.com/business/more-ultra-rich-individuals-interested-in-setting-up-family-offices-in-singapore

Where is the wealth going?

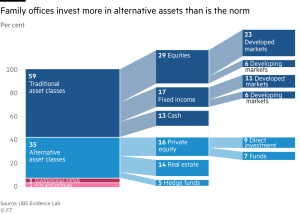

Given how much of this wealth was created (building tech companies) and the nature of the destination region’s growth (again, tech companies) it comes to no surprise that this capital is also looking for similarly tech-focused or venture-backed business targets. That said, even those with no direct ties to tech have become interested in tech-focused investments as well. These investments as LPs or direct investors could potentially be welcomed by the startups themselves, given how investments from Chinese capital, and their overall approach to Southeast Asia’s tech ecosystem, has tended to be more on the collaborative end of the spectrum, as opposed to direct acquisitions or setting up regional HQs to directly compete with local players.

And of course, apart from Southeast Asia, India’s startup ecosystem is also looking for Chinese capital, and certainly open to getting it through deals beyond private equity. With the massive wave of SPAC deals coming through Southeast Asia, and new regional funds emerging, there are more than enough ways for Chinese family offices and HNWIs to invest into the region’s maturing startup ecosystem.

Crypto assets are also not too fringe for these investors, which also makes sense with how familiar they could be with digital currencies gaining traction in China with moves from the PBOC. This Chinese wealth from family offices and HNWIs could be a key proponent in driving greater progress in the digital asset market in Singapore, where there is already a mass of technical talent in the space, and this could potentially trickle through to the rest of Southeast Asia.

Family offices have been increasingly catching the attention of the investment world in the past few years, and their investment preferences are less conservative than some might think. Taken from Financial Times: https://www.ft.com/content/c319839d-d185-4e8a-bbc7-659bebe58031

The Southeast Asia magnet of code and capital

While this exodus is certainly significant on its own, it is also part of the larger picture of talent and capital from both ends of the Pacific moving into Southeast Asia. Companies like Bytedance and Tencent have been aggressively in Singapore, with the former also launching a TikTok Seller University in Indonesia. Ex-employees of these same unicorns and decacorns in China have also begun testing out their product building capabilities in the region, with social media platforms like Buzzbreak built by ex-Bytedance engineers. On the other end of the Pacific, there’s Stripe and Facebook hiring, Ray Dalio’s family office, and of course the many Wall Street SPACs searching for emerging market targets as they mature in the next twelve to twenty-four months.

We are in a very unique time in the history of capitalism. It used to be the case a hundred years ago where factories were built to create wealth but with the rise of the internet and digital technology, it becomes easier and cheaper to create wealth. One simply has to ship code to get a business started and find capital to grow it into potentially a billion-dollar company. This rapidly scalable, high returns combination of code and capital has become more and more attractive as a target for wealth creation. We’re seeing code and capital coming together faster than ever before in Southeast Asia, and the kind of magnet this is creating particularly for Chinese wealth.

This rapidly scalable, high returns combination of code and capital has become more and more attractive as a target for wealth creation.

Paulo Joquiño is a writer and content producer for tech companies, and co-author of the book Navigating ASEANnovation. He is currently Editor of Insignia Business Review, the official publication of Insignia Ventures Partners, and senior content strategist for the venture capital firm, where he started right after graduation. As a university student, he took up multiple work opportunities in content and marketing for startups in Asia. These included interning as an associate at G3 Partners, a Seoul-based marketing agency for tech startups, running tech community engagements at coworking space and business community, ASPACE Philippines, and interning at workspace marketplace FlySpaces. He graduated with a BS Management Engineering at Ateneo de Manila University in 2019.