Latin America is several time zones and an ocean away from Southeast Asia, but there’s a lot more to learn from this similarly exciting emerging market than one might expect. In this episode, Yinglan talks about all that and more with none other than the prolific venture capitalist Eric Acher, co-founder and managing partner of Brazil’s first homegrown venture capital firm monashees. Through monashees, Eric has led investments in many of Latin America’s top tech startups, including 99 (LatAm’s first unicorn), Meliuz (Brazil’s first VC-backed IPO), Rappi, Loft, and Madeira Madeira. He does not only share his experiences leading the development of Latin America’s tech ecosystem as a VC, but also the parallels and synergies with Southeast Asia as well.

After this episode’s transcript, you’ll also find a list of the companies mentioned in the podcast.

Highlights and Timestamps

- 00:27 Eric introduces himself and monashees;

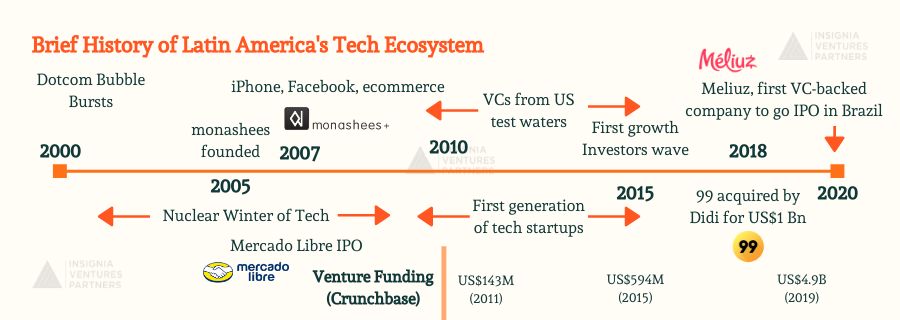

- 03:34 Brief history of Latin America’s tech ecosystem from the dotcom bubble to today; “We basically bet on two things: that the entrepreneurial revolution was going to be global and that Brazil and Latin America were going to be fertile ground for this revolution.”

- 07:27 99, Latin America’s first venture-backed tech unicorn and monashees’ first exit; “99 was built at a time when there was no access to growth capital. So when Uber entered Brazil in 2014 with infinite cash and infinite pockets, it was very hard. 99 did such an incredible job, not only surviving but becoming profitable and competing with Uber until it was acquired by Didi.”

- 10:42 Fintech trends in Latin America and Meliuz, Brazil’s first venture-backed tech IPO; “The first VC backed tech company to go for an IPO in Brazil…Meliuz started out as a loyalty program company based on cashback…And more recently they have actually realized that with that business model, they can really be more ambitious in terms of becoming a fully digital bank with credit cards and everything.”

- 13:22 LatAm companies inspired by China and US models and uniquely LatAm companies; “Major part of the market is actually formed by companies that are inspired by things that are happening in the US or in China…But today we start to see two very interesting things. We see companies…addressing local problems that don’t necessarily exist in other countries…we also see now companies that are innovating in terms of business models globally.”

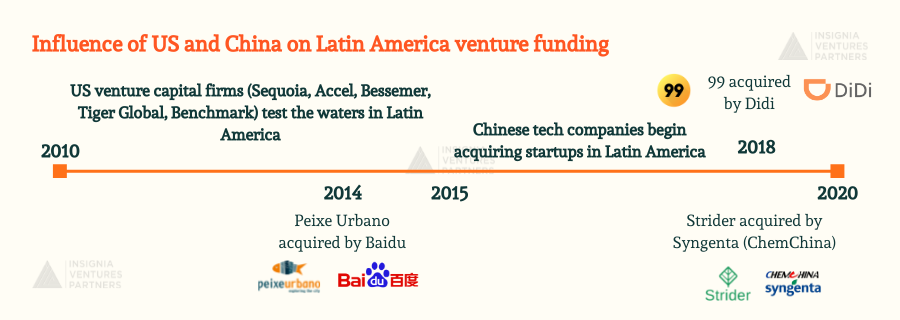

- 17:35 Influence of the US and China tech capital on Latin America; “There is a movement also coming from China, but I think naturally because of time zones and because of the historical relationship, I think most of the capital and influence still comes from the US but I see Latin America potentially having a good balanced influence from both countries.”

- 20:38 The entry of Sea (Shopee) into Latin America and synergies between Southeast Asia companies and Latin American companies; “The more competition we have, the better for consumers and the better for developing the market and even more innovation.”

- 22:55 The two “Indonesias” of Latin America; “We will see how this develops, but I don’t see billion-dollar plus companies that don’t have operations and don’t have a relevant presence in Brazil and or Mexico.”

- 26:28 Challenges of being a tech entrepreneur in Latin America; “There are lots of difficulties, but actually there is a silver lining. What compensates for all that is that there’s less competition, because it’s so difficult…it’s so hard that if you can solve all these things, you create a moat, you create an entry of advantage.”

- 29:18 Rapid Fire Round; “Every time I look around and I see the deep inequality that exists in Brazil and Latin America, it gives us incredible motivation to continue to — together with the other players — democratize access to capital, to the best entrepreneurs with the right values, from any background so they can solve the important problems and the inefficiency in the region, create jobs, improve people’s lives, inspire other entrepreneurs and young people. And of course, generate attractive returns.”

About our guest

Transcript

Yinglan: It gives me great pleasure today to have a good friend over today and someone when we first met, we had so much kindred spirits because we find that regions we are investing in have so much similarity. So we have with us today Eric Acher, who is the founding managing partner of monashees and one of our role models whom we hope to become in many years because he has done such an incredible job investing in great companies in Latin America, including companies like Rappi, Loft, Loggi, Madeira Madeira, which I’m sure we’ll talk about in a little bit. And I continue to be inspired and amazed by the cultural dynamism of Latin America and how monashees has done a great job in spotting great entrepreneurs at a very young stage.

I turn it over to Eric who will do a much better job, giving an introduction of himself and also the landscape in Latin America and a quick introduction of monashees because most of our listeners are investors in the region, but we also have limited partners who are listening in. So Eric, over to you, tell us more about monashees and everything to kick it off.

Eric: Sure, well, thank you very much. First of all, Yinglan, it’s such a pleasure and an honor to be here and participate in your podcast. So thank you very much for the invitation. Also, I would like to congratulate you and Insignia for the outstanding work you’re doing in Southeast Asia, my friends, and I think we’re doing very similar things in Latin America and Southeast Asia, which are actually similar regions as we will explore in this conversation.

First of all, I’m a co-founder of monashees. We are a multistage venture capital firm headquartered in Sao Paulo, Brazil. We invest across tech sectors throughout Latin America. We have portfolio companies in Brazil, our biggest market, but also Argentina, Chile, Colombia, and Mexico. These other ecosystems have been developing really fast and well. I started the firm in 2005 together with my co-founder Fabio Igel. I was born and raised in Brazil. I started my career at McKinsey. I worked there for several years and then actually in 1999, I moved to General Atlantic. That was my investment school.

And then in 2005 looking at the opportunity of building an early stage VC in Latin America, nobody really was looking at that opportunity. And I was really passionate about helping entrepreneurs. We started monashees. Since then we started with a very small fund, $12 million fund.

There was nothing really going on at the time. Besides building monashees, we had to help build the tech VC industry together with the other players. Today we’ve raised 10 funds, nine early-stage funds almost 16 years later. We raised one growth fund, an expansion fund. We have US$1.5 billion AUM. We’ve invested in 125 companies, 85 companies are active, and nine unicorns. We have Rappi, 99, Loggi, Madeira Madeira, Loft, and a couple of unannounced unicorns. We currently have six partners, 22 people in the team. We’re very hands-on. We’d like to work very closely with entrepreneurs to build the first generation of world-class tech companies in LatAm and from the very beginning, so we invest a lot in seed and Series A. And we reserved capital for follow on rounds. And recently we raised, as I mentioned, our first expansion funds.

Yinglan: Congratulations, I mean, you always continue to inspire us on what you’ve done. Could you start by describing the tech ecosystem in Latin America today? Because in Southeast Asia I think it’s fairly early in the development. Given what you’ve seen in Brazil, Argentina, how was the evolution in the past few years and how did the whole tech evolution come up and how did these startups start to go regional?

A Brief History of Latin America’s Startup and VC Ecosystem for the next 20 years after the dotcom crash, as retold by Eric Acher

Eric: Actually to understand what’s going on today, I can talk a little bit about what happened in the last 15 years since we started and maybe a bit more, very quickly, because I believe like in Southeast Asia, we are in the first three minutes of the game. It’s just starting up — the entrepreneurial revolution, entrepreneurs with technology and capital revolutionizing markets. This is a very recent phenomenon in the region. But it’s here to stay. Basically we had an early hype, when there was the dot com boom in the late nineties, there was a little bit of a hype in the region. A few companies were built. No real VCs were present. It was more like financial investors. And in the end, there was a bubble, but in Latin America, we only had the bursts. A lot of people lost money, very, very few companies really survived. And then we entered a kind of nuclear winter of tech in the region for almost 10 years from 2000 to 2009.

We started right in the middle of this nuclear winter in 2005. And for the first five years, nothing really happened in Brazil and Latin America. Nobody wanted to be an entrepreneur. It was not a viable career. There were no investors, so we were testing the waters, learning, making investments, making mistakes. We could see the trend growing in tech globally with the launch of the iPhone and then Facebook growing and everything and e-commerce. So we knew it was going to get to the region. We basically bet on two things: that the entrepreneurial revolution was going to be global and that Brazil and Latin America were going to be fertile ground for this revolution.

And that’s what’s happening now, but it’s still in the very beginning. So the first five years nothing happened then between 2010 and 15, there was a first-generation of a combination of factors. With specialist smartphones and more access to technology, you have the first generation of entrepreneurs. Foreign entrepreneurs moving to Brazil. Brazil is doing good economically for Silicon Valley VCs looking at Brazil, repatriated Brazilians. So that was a good combination and you see the first generation of companies created. But still without access to capital, to growth capital, only early-stage capital. So we invested and there was no follow-on, so it was very hard. These entrepreneurs are heroes. They were very resilient. Some of these companies are the ones that are maturing now. You see Loggi, 99 or even Nubank, and a few others, Madeira Madeira, the ones built then. A longer cycle, not a lot of capital.

Then after 2015, this third phase, then you started to have access to capital, growth investors. A lot of capital in the world, low interest rates, they looked at the region, first-generation of companies maturing, a lot of capital being deployed for growth on a relative basis, compared to what it was before. And in the last five years then entrepreneurs have had more access to capital. And then you see companies like Rappi and Loft growing into unicorns in a short period of time, becoming larger companies in shorter cycles.

We’re now, also in the last couple of years, seeing the first liquidity events related to this first cycle, this first 10 year cycle, since 2010, and that’s making the wheels get into motion. Now we have kind of a first cycle completing, growth capital, and we’re very bullish about the next phase, which means even more capital available, larger companies, more local capital, which is very important. Until today it was more international capital. And we start to see the first global Latin American tech companies. The level of ambition from entrepreneurs is going up. Of course, I could talk a lot about this, but this is a brief summary of what’s happening. Today, young talented professionals want to be entrepreneurs. This is very different from 15 years ago. That’s the big cultural change.

“We basically bet on two things: that the entrepreneurial revolution was going to be global and that Brazil and Latin America were going to be fertile ground for this revolution.”

Yinglan: I think we can list a long list of companies that you bet early on that are very successful, but let’s start with two or three. I’d like to bring you back to the first or second company that you’ve ever backed that resulted in a significant exit. I know that you recently had two IPOs very close to each other. Share with us what the journey was like, seeding these companies at a very young stage, helping them in the process. What were some of the things you had to do to get them to where they are today?

99’s road from founding to acquisition by Didi, through the lens of its lead seed investor monashees

Eric: Sure. This company is the first very successful company that really had a great exit. It was 99. 99 was the Grab of Latin America, of Brazil. It really didn’t expand pan-regionally. It was active only in Brazil. We invested. We led the seed round in 2013. And then we led the Series A and then the company continued to grow and was acquired by Didi in early 2018. So it was a four-and-a-half-year cycle, from a very early stage to a billion-dollar exit. So it was acquired for a billion dollars by Didi in 2018. That was a big milestone for us because after 12 years, 12 and a half years starting monashees that was really the first, first big exit. So it took time and I think that you have to be resilient.

And this was a very special company. I think it was a milestone for the whole market, because it was the first unicorn of Latin America, a VC backed billion-dollar tech company in Latin America that started with entrepreneurs raising rounds from the beginning. I have to say at the same time that looking at what’s happened in other countries, 99 could have been a larger company and could have been more of a significant leader in the market, but that’s exactly the point I was mentioning before. 99 was built at a time when there was no access to growth capital. So when Uber entered Brazil in 2014 with infinite cash and infinite pockets, it was very hard. 99 did such an incredible job, not only surviving, but becoming profitable and competing with Uber until it was acquired by Didi. That was an unbelievable journey, unbelievable journey. If the same thing happened in the last five years and 99 had more access to capital, it could surely be a Grab and be a much bigger company, but anyways, very successful, entrepreneurs are incredible, and we’re very happy with that, but I think it’s important to note how the timing made a difference here.

We ended up helping 99 on many fronts. We were very much involved, significant equity and the board seat from the beginning of my partner Carlo. And we helped with our knowledge about marketplaces. In the beginning, we had invested for a few years in marketplaces. We knew how important it was to start on the supply side. It was very important to reduce friction, to bring the drivers, start it only with the taxi drivers and then migrate to the other drivers. That knowledge of marketplaces helped entrepreneurs think about it. Also we helped bring Tiger as a follow on investor. That was another help. And then finally we helped bring talent. We brought a very important COO that became the CEO of the company, Peter Fernandez. We helped him join the company. And so talent, capital, and some market and industry knowledge. Those were the points that we were able to help entrepreneurs in building, but it’s their merit in building an incredible company, that was our first unicorn.

“99 was built at a time when there was no access to growth capital. So when Uber entered Brazil in 2014 with infinite cash and infinite pockets, it was very hard. 99 did such an incredible job, not only surviving, but becoming profitable and competing with Uber until it was acquired by Didi.”

Yinglan: Fantastic story and I’m sure you were pivotal in their success. And, you know, one of my ex-colleagues always makes me wonder whether I’m in the wrong industry — David Velez of nubank, who essentially left my previous firm to start nubank and it’s doing very well. I see that you have a couple of FinTech companies going public. Tell me more about the journey and also how the evolution of FinTech has been in Latin America.

Eric: It’s incredible, what’s happening in FinTech and I have to say that in part, in my opinion, one of the reasons that FinTech is thriving is that we have incredible entrepreneurs really pushing the boundaries and building these new companies in a different way and challenging the oligopolies and the large incumbents. But also I have to say that at least in Brazil and what I know from Mexico, regulators have recognized the importance of competition and the importance of really having a fair regulation to allow for startups to compete. That was a very important factor for the growth of FinTech in the region.

So across all major FinTech segments, we’re seeing this unbundling process across the specific sectors, credit, asset management, investments and insurtech. Every single FinTech sector has incredible companies. It’s still in the very beginning, but there is a lot of potential. And in that sense, we were surprised to see that, probably if you compare on a relative basis, the fintech sector in Mexico ended up developing faster than in Brazil, in a short period of time, very large companies, payments companies and credit companies developing in Mexico. And in Brazil, even though it took a little longer, you have the case of nubank, as you mentioned, which is an incredible flagship, not only regionally, but globally.

And now we’re probably seeing the beginning of a rebundling of fintech, of these hubs, companies that are positioned very well for hubs of rebundling, making acquisitions. And we’re also seeing an incredible trend of FinTech infrastructure. A lot of companies that are providing FinTech-as-a-service, like every company can become a FinTech.

Meliuz is a very interesting example. It’s now a US$1.2 billion company, the first VC backed tech company to go for an IPO in Brazil. Very proud of Meliuz and the entrepreneurs back in November last year, and Meliuz started out as a kind of loyalty program company based on cashback. Very kind of innovative approach, a global ambition at that. And more recently they have actually realized that with that business model, they can really be more ambitious in terms of becoming kind of a full digital bank, so with credit cards and everything. So Meliuz is expanding the value proposition and the business proposition, and it’s becoming a very, very successful company and platform. So it’s one example of how things change fast.

“The first VC backed tech company to go for an IPO in Brazil…Meliuz started out as a loyalty program company based on cashback…And more recently they have actually realized that with that business model, they can really be more ambitious in terms of becoming a full digital bank with credit cards and everything.”

Yinglan: I think one of the interesting things about companies, at least in our part of the region, is that we take proven models that we see in the US or China, and sort of seeing similarities in our markets. Loft is a quick case study that I’d love for you to talk about, where there are some similarities with Zillow and Beike in China, but obviously, Latin America is very different. So how have these companies become uniquely Latin American or Brazil? Because in Southeast Asia you will also see some of these new species. In our portfolio, there’s this company called Pinhome, which is also in the sort of Zillow-type model, but obviously, execution is very different. So I’d love for you to share with us your experience of Loft and any other companies that spin existing models?

Eric: Sure. That’s a great question because even though we understand that from the very beginning of the development of the ecosystem, we see virtually every company kind of copying business models from abroad and it continues to happen. But I prefer to say that these companies actually get inspired by those business models from other countries. And it’s impossible to really completely replicate exactly the business model. If you do that, you’re going to fail, so you have to adapt locally and then you can get inspired by that and then adapt locally. A major part of the market is actually formed by companies that are inspired by things that are happening in the US or in China.

But today we start to see two very interesting things. We see companies that are the local ones that you mentioned that are inherently local, because they are addressing local problems that don’t necessarily exist in other countries. A company like Flash in our portfolio, which is this platform of benefits for companies to employees that actually is anchored by this local regulations of food vouchers that companies have to give to employees in Brazil. That creates the opportunity for a very big business, kind of forming that platform or Jusbrasil which is actually the largest legal tech platform in terms of audience in the world, and solves the problem of government, public information online, or Arquivei which is a data analytics company that actually uses, again, something that’s very local, that companies have to file their electronic invoices for five years according to regulation. That creates an opportunity to have access to incredible information that can then generate a lot of value.

So these are just some examples of companies that are inherently local, but we also see now companies that are innovating in terms of business models globally. So they start in Latin America and then they can expand. A good example is GymPass. It’s a unicorn that actually created this platform for companies to offer gym passes to their employees and expanded to many countries. Some competitors here and there, but it was created in Brazil, and expanded to the world. Another example is Rocket.Chat in our portfolio. It’s an open-source aggregator of communication tools that is already in 80 countries.

Fazenda Futuro is a different angle. Even though it was inspired by Beyond Meat or Impossible Foods, but Brazil is such a powerhouse in food and in meat, second-largest meat consumer, first largest meat producer — that Fazenda Futuro can really compete globally and innovating in terms of technology on the process of food, of how the products are made. So it’s very interesting to see. It’s basically a revolution. Before it was only inspiration to copy business models. And now you see these other models flourishing.

And to answer your question on Loft. So Loft, initially my perspective is that it was very much inspired by Opendoor. It was an ibuyer model, and it started out like that, but quickly the founders, who are outstanding founders, Florian and Mate, realized that basically that is only the first step to create a much larger platform. The inefficiencies of real estate, especially in Brazil and throughout Latin America, are incredible. There’s no transparency, no central listing. The moment you really create a platform that will change the experience of buying and selling real estate on an offer, mortgage, and everything, so it’s a full kind of offering, it’s an incredible opportunity and Loft is executing really well. So that also is very dynamic. You may start with something and then realize there’s a much broader and much larger opportunity, like what I mentioned about Meliuz.

“Major part of the market is actually formed by companies that are inspired by things that are happening in the US or in China…But today we start to see two very interesting things. We see companies…addressing local problems that don’t necessarily exist in other countries…we also see now companies that are innovating in terms of business models globally.”

Yinglan: This is music to our ears. All these companies you mentioned sound pretty amazing. I wanted to shift to the sort of current events which is the US-China trade war and also some of the issues between, I guess the US and other markets. Do you see increasing capital coming from the US and I see some of the Tiger Globals of the world, GA, you know, your old firm, becoming more active in Latin America. And I wanted to understand a little bit because we are seeing some of this as well in Southeast Asia. Because of the US-China trade war, a lot of US capital is coming over. China as well is coming over. I’m not sure where the China capital has gone over to Latin America yet, but I love to see the impact if any that your startups have faced, and how has that influenced the way you look at investments and also working at these foreign investors?

Eric: It’s a very interesting question, Yinglan. I really think that we have more US investments in the region lately because of the opportunity that Latin America represents. If we look back, the first investors between 2010 and 15 in Brazil, especially, all came from the US, so Benchmark made an investment, Accel, Sequoia, and all the others, and Bessemer, all actually invested and tested the waters. Tiger was here. Then actually in the last five years with the growth of China. And actually, there are similarities between Latin America as an emerging market and China, sometimes in some markets, in some segments, even more similarities between Latin America and China, than between Latin America and Silicon Valley. We actually took 55 of our founders from our portfolio to China back in 2016. And that was an eye-opening trip because for some companies, like Madeira Madeira, it was transformation. They really realized the power of the speed of execution and growing and scale and ambition in the face of infrastructure challenges in an emerging market. It can have a very important role in Latin America.

For us, for example, 70% of our capital from our LP’s comes from the US. It’s the same as far as I know from other leading VCs in the region. Then most of the capital being invested in the region comes from the US, from growth investors. They’re not very active in the early stages, but they’re looking more and more now. Now I have to say that lately, China, for example, acquired some companies. Our first two exits, Peixe Urbano was acquired by Baidu and then 99 was acquired by Didi. And then we had actually an agritech company called Strider was acquired by Syngenta, which is Chem China. So there have been Chinese acquisitions in the region. I think they are looking and investing too, Alibaba, Tencent, Ant Financial investing in the region. No venture firms investing, very, very rarely. And we have a couple of Chinese LPs. So there is a movement also coming from China, but I think naturally because of time zones and because of the historical relationship, I think most of the capital and influence still comes from the US but I see Latin America potentially having a well-balanced influence from both countries.

“There is a movement also coming from China, but I think naturally because of time zones and because of the historical relationship, I think most of the capital and influence still comes from the US but I see Latin America potentially having a good balanced influence from both countries.”

Yinglan: We also see a very interesting sign, which is one of our Southeast Asian companies Sea started to expand into Latin which we were very intrigued by and I wonder whether you see the similar source of interplay between, well, Sea being obviously a frontrunner, partly driven by their game having lots traction in Latin America, I wonder whether you see interesting things like what Sea can do and potentially more companies in Southeast Asia going over to Latin America.

Eric: I think it’s just a matter of time until we have many examples like this. Latin American companies going to Southeast Asia and Southeast Asian companies coming to Latin America. It’s going to happen and maybe Sea is one of the first examples. Of course, in gaming, it’s easier. We also have Wildlife. It’s a very large gaming company from Brazil that is global, and I’m sure it’s present in, not with a local office, but of course, it reaches all the world, including Southeast Asia, and it’s the same with Garena, Sea’s gaming company. That’s more natural.

Now, local operations, that’s more difficult. And when we see Shopee, which is the e-commerce operation of Sea, getting to Brazil and Latin America, that’s a very important move and for us, it’s great news. Because Sea is an excellent company. It can really bring more competition, help local players improve their products, and improve their offerings. It’s great news. It will be very interesting to see what happens. It’s important to say that e-commerce in Latin America is not easy. It’s not easy around the world, but in Latin America, it’s especially challenging because of logistics. It’s a large area, and it’s hard to get to places. And then logistics infrastructure is more complex. People are used to having free shipments. They always want free shipments. So that is incorporated in the price. People like to buy in installments, which increases pressure on working capital. So there are some interesting kinds of local characteristics of e-commerce that made, for example, Amazon has been getting into Latin America gradually for many, many years.

So they’ve been very slowly now accelerating, but they didn’t just enter. Walmart sold their Brazilian operation. So it is hard to enter e-commerce from abroad. But I’m sure that Sea knows that and it’s doing it with Shopee and hopefully, it will be a very successful operation for us. The more competition we have, the better for consumers and the better for developing the market and even more innovation.

“The more competition we have, the better for consumers and the better for developing the market and even more innovation.”

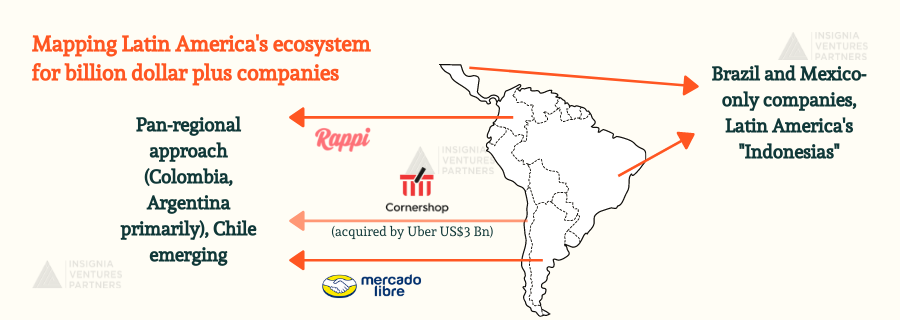

Yinglan: That’s great. I want to shift gears, because we also have a lot of entrepreneurs and in our listenership, which is at least in Southeast Asia, we sort of guide our founders, that, the king is Indonesia, the queen is Vietnam and the Jack is the Philippines, and then if you can go regional, you are the So I guess, Brazil, Argentina there’s some similarity. How would you advise investors to think about Latin America as a market to invest in and how would you advise entrepreneurs to think about regional expansion in Latin America?

Eric: Very interesting question, because I was looking at the numbers. I was surprised to see how similar Latin America and Southeast Asia are in terms of GDP. The GDP is US$4 trillion in Latin America, US$3 trillion in Southeast Asia. The population is 600 million in Latin America, 650 in Southeast Asia, if I’m not wrong, but in terms of tech investments, for example, last year Southeast Asia had US$8 billion in venture capital investments and Latin America only US$4 billion. So it’s half of the size still. So there’s more capital going to Southeast Asia. Even though the aggregate GDP in Latin America is larger. So it shows the potential. Both regions can grow a lot.

I think the difference starts when you see the fragmentation of countries. I think Latin America, of course, we include the Caribbean, there’s a lot of countries there, but I mean as significant countries in terms of population, relative land size, and all countries are significant, but there is more of a concentration in Latin America around two larger countries, Brazil and Mexico are the two countries that have GDP above a trillion dollars. And in Southeast Asia, you have only Indonesia. And then you have Vietnam, Philippines, but then it gets fragmented.

In Latin America, if you enter the region, it’s about Brazil and Mexico. If you want to build very large companies, billion-dollar-plus companies, you have to be in Brazil or Mexico, or you can start in Colombia and expand pan-regionally. For example, it’s what Rappi did. It’s from Colombia. So other countries like Colombia and Argentina, for example, because they are smaller countries, naturally look at expanding regionally. It’s what happened with Mercado Libre, the most successful tech company in the region. It started in Argentina, expanded very early during that first cycle, started in 98, 99, and a very successful NASDAQ IPO in 2007. They were proof that it’s possible to do pan-regionally, starting from one kind of a smaller country. Argentina is kind of a medium country, but it’s not as large as Brazil or Mexico. Colombia did the same with Rappi and a few others, Frubana and a few other companies.

So what happens is that you have countries that have this vocation to expand, and they’re always looking from the very beginning to expand. And then you have countries that don’t have that incentive. Brazil and Mexico, they’re more contained. Entrepreneurs are now expanding. We have several examples of companies from Brazil expanding to other countries now and Mexican companies also expanding, but there’s no tradition in that. There’s no history. So it’s new for them because they can build large companies internally. So international expansion is an option value, and for Colombia and Argentina, it’s a necessity.

So I think you have to look at each country in a different way. We also have the case of Cornershop acquired by Uber for $3 billion. It’s a Chilean company started in Chile. Chile can be also, we just invested in our first Chilean company, another country that has the potential to be like Colombia and Argentina. So we will see how this develops, but I don’t see billion-dollar plus companies that don’t have operations and don’t have a relevant presence in Brazil and or Mexico.

“We will see how this develops, but I don’t see billion-dollar plus companies that don’t have operations and don’t have a relevant presence in Brazil and or Mexico.”

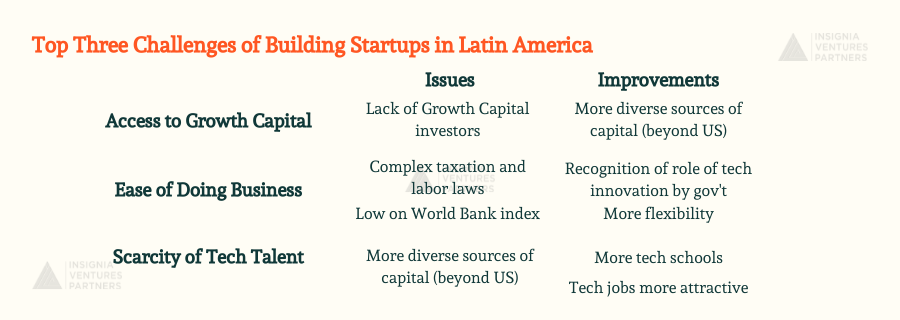

Yinglan: Got it. Super intriguing. The way I think about it in Latin America is you have two Indonesias in Brazil and Mexico which is great. I wanted to shift a little bit about the challenges for entrepreneurs. Obviously, I think the market’s massive. What are the other two or three top challenges for entrepreneurs building a massive company in Latin America?

Eric: Well, until recently there was the question of access to capital. And now this has been solved, but still we have, in my opinion, many more opportunities than capital being invested. So still for a lot of talented entrepreneurs, access to capital continues to be a challenge.

Then we have the difficulty of doing business. You know, there’s the World Bank’s kind of ranking of countries in terms of ease of doing business and Brazil is probably number 127, something like that. It’s hard. There’s a lot of bureaucracy, a lot of laws, the tax structure is very complex. There are taxes at a federal level, state level, city level, so to do e-commerce is very hard. When you go across regions, labor laws are for a reason very protective of employees. And that is good but it was created in the thirties when of course there was a lot of sense to do it. So they should be a bit more flexible now. And they are working on that. So it’s improving, but it’s not improving that fast. The challenge probably is that it’s not an easy place to do business, so entrepreneurs have to be especially resilient and especially have the kind of perseverance to really build their companies.

There are lots of difficulties, but actually, there is a silver lining. What compensates for all that is that there’s less competition because it’s so difficult. So when people say in the US it’s very easy to create a company. But then the next day you have 20 companies doing the same thing you’re doing, with more capital than you and a better team. You have that benefit, if you really do it so hard that if you can solve all these things, you create a moat, you create an entry of advantage.

The last thing that I forgot to mention as a challenge is the scarcity of tech talent. This increases the salaries of tech staff. It’s harder to get but there is. There is the availability of incredible tech talent and it’s growing. You have a proliferation of tech schools. So this gap is going to be solved very soon. Of course, there’s another force now with remote working and tech people being approached by international companies. It is also complex and then the exchange rate plays a role here. So we will see how this develops, but it’s very clear now. People know that a career in tech means jobs. And so you have this incredible number of people just being trained in companies, being formed by tech schools, going to colleges and universities. So there’s in my opinion, a temporary gap, but it’s currently a challenge.

Yinglan: Got it. The challenge is what makes life interesting in the process.

Eric: Exactly. If it was easy, it would not be fun.

“There are lots of difficulties, but actually there is a silver lining. What compensates for all that is that there’s less competition, because it’s so difficult…it’s so hard that if you can solve all these things, you create a moat, you create an entry of advantage.”

Rapid Fire Round

What are the top three traits of a great VC?

Eric: First is actually resilience and patients. The first cycle for any VC will take 10 years and you have to really want to do it and help entrepreneurs. And not really think about the rewards too soon. Of course, you can win the lottery. in two years, have an incredible exit, but it takes time. And so resilience and patience to go through good times and bad times are key.

Second I’d say it’s very important to have a collaborative approach to build lasting relationships with founders and always thinking about maximizing the long-term not maximizing the short term. It’s not being transactional, being collaborative. You may lose here and there in a short time, but it will really build the relationships and the reputation that you need in the long run as a VC and especially in Latin America, where traditionally financial investors had all the bargaining power and were never collaborative. That makes a big difference.

The last one is the ability to move fast, make decisions fast, identify patterns, make connections across many parallel channels. There’s a sea of information but you have to move fast and that’s very important.

What is the most definitive trait of a founder you would invest in?

Eric: It’s similar in the sense, I really think it’s grit. This combination of passion and perseverance. Angela Duckworth had that great book about it. There’s a great quote from her that says, “Enthusiasm is common. Endurance is rare.” You have to be ready for incredible amounts of work and challenges and difficulties for a long time and go from failure to failure with the same enthusiasm.

What was the biggest thing you learned from working with founders that has influenced your own personal life or investing style?

Eric: Let’s see, that’s an interesting one. I’d say that, especially for founders in Brazil, with the stories I’ve seen, that we’ve lived together, the journeys and everything I have to say. It’s that nothing is important. Nothing is impossible. You see entrepreneurs coming from incredibly humble backgrounds, just building incredible companies, very, very inspirational. It’s so difficult to do business in the region but to see them show this determination and ingenuity and resilience shows that nothing’s impossible.

What was your biggest miss as an investor?

Eric: There are many misses. We could have a long conversation about this, but I’d say using the criteria of value of the company today, My biggest miss was Mercado Libre, Series B when I was at General Atlantic (GA) in 2000. So I took that opportunity to the investment committee of GA. This was right after the crash. Mercado Libre was raising a Series B and we discussed it, but it was very hard to make the decision at that point, psychologically. We knew the founders, incredible entrepreneurs. There was a big opportunity, but right after the crash, it was very hard to make the decision. So we passed and then seven years later, they did the IPO. Today they are a US$70 – 80 billion company. The leading company — I think it’s the largest tech company outside of the US and China.

What is one thing that founders you’ve worked with would say about you?

Eric: This is so hard to answer, they have to say it, but my impression, at least what I’ve heard from founders before, is that they value my ability to have empathy with them and put myself in their shoes in different situations. That builds important bridges.

What is the biggest thing that keeps you going in your career?

Eric: I know probably several VCs say things along these lines, but what we do is basically we want to generate, you know, attractive returns to our investors as a consequence of helping entrepreneurs build world-class tech companies in Latin America. This is what we do, but I have to say, this is not why we do it. Both Fabio and I from the beginning, we really believe in this entrepreneurial revolution as a possibility to change the region. Every time I look around and I see the deep inequality that exists in Brazil and Latin America, it gives us incredible motivation to continue to — together with the other players — democratize access to capital, to the best entrepreneurs with the right values, from any background so they can solve the important problems and the inefficiency in the region, create jobs, improve people’s lives, inspire other entrepreneurs and young people. And of course generate attractive returns. So we continue this virtuous cycle and we can reshape our region. I think behind everything that’s the force that motivates us the whole team of Monashee sensing.

“Every time I look around and I see the deep inequality that exists in Brazil and Latin America, it gives us incredible motivation to continue to — together with the other players — democratize access to capital, to the best entrepreneurs with the right values, from any background so they can solve the important problems and the inefficiency in the region, create jobs, improve people’s lives, inspire other entrepreneurs and young people. And of course generate attractive returns.”

Latin American Startups Mentioned in the Episode

- 99: “99 was the Grab of Latin America, of Brazil. It really didn’t expand pan-regionally. It was active only in Brazil. We invested. We led the seed round in 2013. And then we led the Series A and then the company continued to grow and was acquired by Didi in early 2018.”

- Meliuz: “You mentioned Meliuz, which is a very interesting example. It’s a company that started, it’s now a $1.2 billion company, the first VC backed tech company to go for an IPO in brazil. Very proud of malleus and the entrepreneurs back in November last year, and who started Meliuz out as a kind of a loyalty program company based on cashback. Very kind of innovative approach, a global ambition at that. And more recently they have actually realized that with that business model, they can really be more ambitious in terms of becoming kind of a full digital bank. So with credit cards and everything. So Meliuz is expanding the value proposition and the business proposition, and it’s becoming a very, very successful company and platform. So it’s one example of how things change fast.”

- Flash: “A company like Flash in our portfolio, which is this platform of benefits for companies to employees that actually is anchored by these local regulations of food vouchers that companies have to give to employees in Brazil. That creates the opportunity for a very big business forming that platform.”

- Jusbrasil: “Jusbrasil which is actually the largest legal tech platform in terms of audience in the world. And solves the problem of government public information online.”

- Arquivei: “Arquivei which is a data analytics company that actually uses something that’s very local — that companies have to file their electronic invoices for five years according to regulation. That creates an opportunity to have access to incredible information that can then generate a lot of value.”

- Gympass: “It’s a unicorn that actually created this platform for companies to offer gym passes to their employees and expand it to many countries. It was basically created with this exact business model, of course there were some competitors here and there, but it was created in Brazil, and expanded to the world.”

- Rocket.Chat: “Another example is Rocket.Chat in our portfolio. It’s an open source aggregator of communication tools that is already in 80 countries.”

- Fazenda Futuro: “Fazenda Futuro is a different angle. I mean, Even though it was inspired by beyond meat or impossible foods, but Brazil is such a powerhouse and in food and in meat, second largest meat consumer, first largest meat producer — that Fazenda Futuro can really compete globally and innovating in terms of technology on the process of food, of how the products are made. So it’s very interesting to see. It’s basically a revolution. Before it was only inspiration to copy business models. And now you see these other models flourishing.”

- Loft: “So Loft, initially my perspective is that it was very much inspired by Opendoor. It was an ibuyer model, and it started out like that, but quickly the founders, who are outstanding founders, Florian and Mate, realized that basically that is only the first step to create a much larger platform. The inefficiencies of real estate, especially in Brazil and throughout Latin America, are incredible. There’s no transparency, no central listing. The moment you really create a platform that will change the experience of buying and selling real estate on an offer, mortgage and everything, so it’s a full kind of offering, it’s an incredible opportunity and Loft is executing really well.”

- Madeira Madeira: “They really realized the power of speed of execution and growing and scale and ambition in the face of infrastructure challenges in an emerging market.”

- Peixe Urbano: “Peixe Urbano was acquired by Baidu…”

- Strider: “…And then we had actually an agritech company called Strider that was acquired by Syngenta, which is Chem China.”

- Wildlife: “We also have Wildlife. It’s a very large gaming company from Brazil that is global, and I’m sure it’s present in, not with a local office, but of course, it reaches all the world, including Southeast Asia, and it’s the same with Garena, Sea’s gaming company.”

- Rappi: “If you want to build very large companies, billion dollar plus companies, you have to be in Brazil or Mexico, or you can start in Colombia and expand pan-regionally. For example, it’s what Rappi did. It’s from Colombia.”

- Mercado Libre: “the most successful tech company in the region. It started in Argentina, expanded very early during that first cycle, started in 98, 99, and a very successful NASDAQ IPO in 2007. They were proof that it’s possible to do pan-regionally, starting from one kind of a smaller country.”

- Frubana: “Colombia did the same with Rappi and a few others, Frubana and a few other companies.”

- Cornershop: “We also have the case of Cornershop acquired by Uber for $3 billion. It’s a Chilean company started in Chile.”