A case study on Singapore-headquartered regional fintech Aspire, on its past four years of building an all-in-one finance platform for growing businesses.

Highlights

- Their credit-led approach to building a financial OS unlocked proprietary distribution and data

- Leveraging this distribution and data to forge industry partnerships that cost-effectively scaled their stack of services

- Focusing on designing for simplicity and intuition as their app became more multi-product and multi-market

- Digitizing not just financial services for SMEs, but also the connectivity between these services has been key to expansion

- Growing with their target customers drives their evolution as a company

This month Aspire celebrates its fourth year anniversary (Feb 25th officially). Since its launch in 2018, the company has grown to become an all-in-one finance ecosystem for SMEs across Southeast Asia, covering multiple offerings from payment services to finance management software. In 2021, the company crossed US$2 billion in annualized transactions with more than 10,000 business accounts opened and raised its Series B to top up what’s now a US$200 million debt and equity war chest.

While there’s still much more growth to be had for the multi-awarded Singapore-headquartered, regional fintech company, the key foundations that will shape the company’s future trajectory have already been laid these past four years, and what better way to celebrate four years than to deep dive into these foundations: what has enabled Aspire to reach this level of growth?

We cover five elements behind the company’s pioneering evolution into an all-in-one finance operating software for SMEs. This mini-case study features insights from CEO and co-founder Andrea Baronchelli and Aspire leaders on podcasts, press releases, and media features from 2018 to 2021.

Also check out: We’ve also done mini case studies on the growth trajectories of Appier, Shipper, and Ajaib.

Looking to take on leadership / executive roles in Aspire or any of our portfolio companies? Explore the opportunities by sending us an email about yourself and what you’re looking for to career@insignia.vc.

Looking to grow your career at one of the fastest-growing fintechs in Southeast Asia while helping businesses in Southeast Asia grow just as fast? For more open roles with Aspire, check out their career page.

(1) Credit today, tomorrow the world: Building a credit-led financial OS for SMBs

All SME roads lead to fintech

“Every tech company is a fintech company” is the meta these days, but even back in 2018 at the height of ecommerce and ride-hailing platforms raising megarounds, ecommerce leaders were already seeing the need for more equitable access to working capital especially for ecommerce-first brands and businesses.

Aspire CEO Andrea Baronchelli was no different. According to Tech in Asia’s coverage of the company’s fresh-from-YC seed round, the founder’s time at Lazada (where he was Vietnam CEO then CMO) saw him identify working capital shortages as a key pain point for ecommerce because traditional banks could not readily take on the risk of serving these customers or the SME’s don’t need as much as what bank usually disburse.

The year before Aspire launched, in 2018, a study found that US$245 billion worth of financing was disbursed by alternative credit platforms in APAC in 2016. Clearly, there were existing alternatives but Southeast Asia’s markets remained underpenetrated and not all of these alternatives were scalable across such a diverse region.

Taking the credit road to neobanking

While Aspire’s founders came to the table recognizing these pain points of SMEs’ access to working capital from their experience with commerce platforms, the north star for the company from day one was never just to build a credit platform. The big vision was to be Southeast Asia’s #1 SME Finance Platform, but credit would be the key to this vision.

Aspire CEO and co-founder Andrea Baronchelli

As Andrea shares on our podcast in 2020, Aspire found itself in a blue ocean because of the complexities of scaling banking services across the region. “The model of an SME banking has been around for a while outside globally and there are various models. Southeast Asia is more complicated because by itself it’s made of different countries with different jurisdictions and different frameworks. On the other hand, compared to other parts of the world, the industry is really nascent. So the opportunities are bigger due to the lack of a lot of players trying to solve these problems. And so at the same time, I mean, we see a great opportunity here for us.”

So why was credit the first step? For many fintechs, regardless of the starting point, credit is often the destination for monetization and profitability. As Andrea mentions in the podcast, “Typically, there’s a lot of payments-led fintechs, right? But if you talk to them, they will pretty much always tell you that [they are] trying to monetize via credit. Either they have it in the plans or they’re testing it out, or they are doing a bit on the side just to add some revenues on the topline, but it’s pretty clear in the industry, that’s one fundamental way where eventually the path to profitability needs to come from.”

By heading straight there from day one, Aspire was able to create a sustainable base for its business model. As Andrea put it in the podcast, they could better synergize the credit product with their transaction/banking products and master both.

“For us it’s really important, the synergy between the credit product and the transaction banking product, because we are one of the few players that managed to basically master both, which is a bit [like] the Oaknorth example you mentioned before, right? The successful SME neobanking player that is credit-led.”

Specifically, having a credit-led approach to becoming an SME neobank in Southeast Asia enabled Aspire to:

- quickly leverage data (acquired through their risk assessment engine) and distribution to open up more banking services beyond credit

- monetize this credit business, and offer their other banking services at rates cheaper than other players (e.g. lower fees on payments/transfers)

- create a lot of paths to profitability, as a result of both the credit business providing that source of monetization and potentially increasing margins on other services as well

When it came to building a world-class credit value proposition, Aspire optimized for the best possible customer experience by bringing together a proprietary risk assessment engine and a balance sheet model (i.e. money lent comes from its own funds). The former tapped into non-conventional data (e.g. real-time business transactions, online ratings, and social activities) for new-age SME credit scoring that was the bread-and-butter for a self-evolving and scalable credit service (i.e. an early version of channel finance). Meanwhile the latter allowed the company to aim for speed and reliability in deploying loans.

Read more on the evolution of credit into channel finance

This credit-led approach rings similar notes to many successful neobank approaches across the world, even for consumer neobanks. Once again, it’s not just about profitability (although this is certainly a big benefit to chart that path from early on), but also a compelling go-to-market (as opposed to payments) that strengthens retention and unlocks more services through data and distribution.

This go-to-market was backed early on in a US$9 million seed round by Y Combinator after Aspire went through the Winter 2018 cohort, along with us at Insignia Ventures (one of our early investments) and Hummingbird Ventures. Then by July 2018 in Aspire’s seed round announcement they already had 100 clients availing of their credit line product.

(2) “Future of Banking is a Marketplace”: Building the all-in-one platform through partnerships

Account-Based Flywheel

Another meta for tech companies’ growth is the so-called “flywheel”, or spread of services that come out of a core service. True to its neobank vision, Aspire’s approach to its flywheel was not to create siloed products on a platform, but through a single business account (their flagship product, the AspireAccount) where customers could not just get an instant credit limit for daily business expenses, but also other B2B transaction and cash flow management tools.

To understand Aspire’s flywheel, we go back to the pain points they identified in the SME’s banking experience, which extend beyond access to capital. As Andrea details on our podcast in 2020, they focused on four. “From an SME perspective, when you think about financial services, it means speed, transparency, a level of support and access to capital. So these are the fundamental pain points that small business owners are facing and this is exactly what we’re trying to solve by focusing on their experience.”

Becoming the fully-fledged SME banking partner

And to address these pain points, it’s not just about building a neobank, but a fully-fledged banking brand SME’s would consider to be their partner in all things financial services. That’s what these pain points boiled down to: a lack of a banking brand SMEs could rely on and trust.

As Andrea shares in the podcast, “We started our journey helping these SMEs that are unfairly underserved by the incumbent financial institutions with a credit line product in 2018. And then we opened up as you said to more and more products to complete our offering. And we realized that, as we were building Aspire, that a full generation of new entrepreneurs and business owners, they didn’t have a banking brand that they felt connected with and that was offering digital financial services with speed and transparency that they expected. And so we found a great opportunity to create a fully-fledged SME banking platform to become their banking partner. So that’s our journey so far.”

Aspire team in 2019. Taken from fintechranking.com

By the time Aspire raised its Series A round in 2019, the company was already seeing 1,000 business accounts being opened each month and 30% growth month-on-month. This was proof to the company that they were on the right track to build this reliable brand. Yet they still saw a long road ahead for scale, with Andrea sharing in media interviews the market potential of around 78 million small businesses that Aspire could reach in the region through their banking platform.

The CEO added in the TechCrunch coverage of the Series A round that “the bank of the future will probably be a marketplace” where SMEs could also access various business services through the Aspire platform like POS systems. It was clear with the momentum of new business coming on board the company was ripe for more offerings.

Why reinvent the wheel?

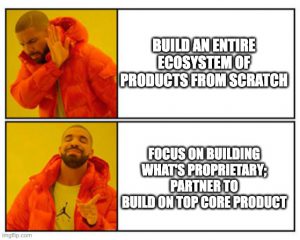

The question then is, how did Aspire develop the ecosystem of products on its flywheel?

The short answer: They didn’t do it all themselves. Why reinvent the wheel when you can build the car? Again, going back to the idea of a “marketplace”, Aspire was in a prime position with the distribution and data they had aggregated through their credit line product to tap into partnerships. Note that the partnerships would not have made as much sense for the potential partners (e.g. global companies and banks) if they did not have the foundation built out by their initial core product.

As Andrea shares on our podcast in 2020, “So the idea for us is that we want to serve our customers right around the full spectrum of banking products, so what I mentioned a bit before and with the best possible offering obviously, and the approach for us is that if we find awesome services right in the market, that our customer might benefit from we’d just prefer to integrate them. For example, with the TransferWise FX rates and the idea is basically to not build everything from scratch, right?

For other services, for example, where we feel that there’s no players, maybe in the market that can execute at the level of service where we would love to serve our customers, we might decide to implement it ourselves. The example for us was some of our credit line products, and we can do it ourselves. And again, it basically built up this sort of full-fledged [ecosystem of] services that we want to bring to our target demographics.”

Aspire basically went putting together all the existing “wheels” out there — the best platforms or services catering to what they wanted to offer — and if it was out there in the market, they would partner. If it was not, they would do it themselves. It’s all in pursuit of being that fully-fledged banking partner, and reliability means having it all.

In early 2020, Aspire announced the launch of its Aspire Corporate Card developed through a partnership with Visa and global fintech platform Nium. The corporate card, linked to AspireAccount, offers its users a more seamless digital experience for day-to-day business expenses while also enabling the business to track cash flow and expenses.

Win-Win Partnerships

For Aspire’s partners in developing these offerings to its customers, from banks to fintech companies, there’s also a lot of benefits in that they are able to tap into Aspire’s distribution of SMEs. As Andrea explains on the podcast, “So the key for us is that we are targeting a specific demographic of SMEs that prefer a digital-native brand and an open ecosystem platform. So we are talking about digitally savvy, early adopters, generally young people that still manage a business, right? And we build an in-house core banking system that allows us to connect with existing ecosystems and stay relevant.

Because nowadays the type of tools that these businesses use, they change fast and they want this tool to be integrated with their cash flow management system. To our bank partners, we are that effective acquisition partner and retention partner from which they can get business, whether it’s deposits or credit opportunities and revenue shares.”

Venkatesh Saha, TransferWise’s head of Asia-Pacific and Middle East expansion, and Andrea Baronchelli, co-founder of Aspire. Taken from The Business Times

A Wise Choice

By July 2020, Aspire unlocked low-cost international money transfers from its AspireAccount through a partnership with TransferWise (now Wise), addressing a long-standing pain point of forex transaction costs.

In the Business Times coverage of the partnership, Andrea shares, “Our aspiration and mission is to provide easy, fast and transparent banking solutions to the thousands of businesses that form the backbone of the economy here in Singapore and across the region. Leveraging TransferWise’s open API (application programming interface) allows us to do this without much additional and expensive build, enabling us to unlock cross-border payments for our thousands of customers quickly and easily.”

(3) Strengthening retention in a multi-product, multi-market app by going for simplicity

Perks of a Distributed Team

By the second half of 2020, Aspire had its feet in four markets already, operating in Thailand, Indonesia, Singapore, and Vietnam. This expansion was not just in terms of product but also on-the-ground teams and leadership. It helped that Aspire’s founding team had operated in these markets already in prior companies, but the key for Aspire in this market expansion was ensuring they are always close to their customers.

On our podcast in 2020, Andrea talks about the flexibility they have as a company because of their distributed leadership and teams across the region. “We find it really helpful to have a distributed team because we need to make sure that we are always trying to be close to our customers and for us it has been working quite well. We started from the beginning as quite a distributed team.

I mean, obviously, we have people now working remotely anyway but even in the past, we had a lot of interaction across various jurisdictions. We have a lot of our regional strategies and teams that are taken not from people sitting in Singapore, even if Singapore is our headquarters. And this allows for the company to be not really centered, but it’s basically moving as the market is basically evolving.”

Rapid Expansion = Upgrade for Stronger Retention

This growing regional presence across several markets, and just an overall growth momentum in customers engaging in services beyond their credit line product necessitated an upgrade in their platform.

Damien Passavent, Head of Product at Aspire

Specifically, Aspire wanted to improve retention. As we write in a feature of the Aspire 2.0 app and their head of product Damien Passavent, “For Aspire, what they wanted to achieve with Aspire 2.0 business-wise is to increase conversion rate from leads and signups to their north star metric: engaged accounts (repeating, loyal customers).”

Strengthening Retention through Human-Friendly User Experience

That meant really developing a unique experience on their platform taking into account feedback they had collected, from more proactive and accessible customer service, FAQs, and product support (e.g. search features for info about fees and brief explanations on how features work) to rolling out these offerings differently across specific markets (e.g. rewards for onboarding differ in Singapore and Indonesia).

This initiative of improving the simplicity and intuitive-ness of the app across the various markets they are in was summed up by Damien as “making the app more human-friendly…Through the product, we are talking to the customers, and we wanted to make sure that using Aspire would be as easy as talking to a human assistant.”

All in all this evolution in Aspire’s app was an evolution towards simplicity amidst an increasingly complex ecosystem that did not just have to take into account the products themselves but the nuances of the markets where they were being offered.

(4) From Transactions to Connectivity: Building the OS for SME Banking

Neobank is old news

By 2021, Aspire was reaping the rewards of its app revamp and the rapid growth of its banking services stack following the launch of corporate cards, online business accounts, and money transfer services, among other services. A year to the month since launching their online business accounts amidst the initial onslaught of the pandemic, addressing a need for fully digital solutions and building on top of their multi-product strategy, Aspire saw more than 10,000 companies using the company’s business accounts and annualized transactions cross US$1 billion.

While the banking flywheel was growing, Aspire also recognized that beyond financial transactions, customers across their board were also using the financial management services on the app, especially businesses relying on Aspire as their primary business account or using the platform for expense management. They also observed through customer interviews just how clunky and fragmented their financial management toolkit has been and the opportunity there was to consolidate this on Aspire.

From Digitizing Transactions to Digitizing Connectivity

If Aspire already had the platform for the accounts through which all these transactions were happening, why not also create that software layer to digitize the data and connectivity across all these activities?

And so in their Series B announcement in September 2021, Aspire emphasized their expanded vision to go beyond neobanking to also become the “operating software” for SME financial services. This concretely reflected as well in the new offerings and features Aspire launched throughout the year, foremost among them BillPay, enabling their customers to process invoice payments in a more streamlined, time-efficient, and scalable manner.

They even featured a case study with a fellow Insignia-backed company, B2B procurement platform Eezee, where Aspire’s BillPay helped Eezee process the high volume of transactions they were getting through their marketplace with over 1,500 suppliers, effectively (1) eliminating manual data entry work, (2) optimizing cash flow through better scheduling, and (3) saving on local and international transfers. Of course using the BillPay with their Aspire account also helped Eezee monitor and account for all these transactions even at scale.

What’s important to note is that through Aspire’s expansion into an all-in-one finance operating software for SMEs (neobank + financial management), it hasn’t just been about launching new services, but more importantly integrating their growing flywheel of services through a software layer. If the neobank trajectory meant bringing financial services online, this operating software trajectory means bringing the connectivity between these services online as well.

Joel Leong, co-founder and Singapore country head of Aspire and Kevin Fitzgerald, Managing Director of Xero Asia. Taken from Aspire.

Of course, this expansion still incorporated the previous two elements we had covered: working with partners (e.g. interoperability with existing accounting software like Xero) and developing a user-friendly, intuitive experience (e.g. AI-driven connectivity between emails and Aspire account and invoices on BillPay).

It’s all part of the plan

Aspire raised its Series B on this expansion and its potential to become even bigger than its initial neobank vision. The round consisted of US$58 million in equity and US$100 million in debt, with participation from the likes of DST Global, B Capital, and other growth-stage investors, as well as hedge fund Fasanara Capital. By the round’s announcement in September, the company had also doubled the milestone they had crossed in May with US$2 billion in annual transactions.

Again it’s not just about the services themselves but also the connectivity. And with Aspire having built their advantage with this multi-product strategy from day one (and it’s still ongoing as they develop tools for accounts receivables and payroll management), it makes all the more sense to digitize the interoperability and connectivity aspect of the equation as well.

As Andrea shares on the TechCrunch coverage of the Series B round, “What we’re trying to do is connect traditional banking services with software because we realize the biggest problem is that these two are completely disconnected. So you have access to accounts, cards, but those are not powered by software. By putting them together, our vision is to move beyond the concept of digital banking and basically create an operating system where this banking product and software will co-exist.”

(5) Aspire’s Throughline: Growing with SMEs

Revenues for me, revenues for you

While Aspire’s horizons have expanded since it was founded in 2018, they’ve remained steadfast and focused on helping SMEs and being there as their customers grow. Even specifically for their credit lines, Aspire’s allocations for loans have constantly expanded, essentially becoming “moving targets”.

As Andrea shares on our podcast in 2020, and remains relevant today as Aspire celebrates four years, “We’re basically building our company to help SMEs and be there as they grow. So we will always be looking around for products and services they need from [us] and try to find the best way to serve them. So we like to think about it as a way to honor entrepreneurs, right, and to really try and to make sure that they identify us as someone that has built a business centered in them, which is not something that they see frequently.”

Even beyond the paid services, Aspire has developed programs and services like Aspire Kickstart (incorporation for Singaporean companies) to cover other, but still important, needs of growing SMEs.

The most successful venture-backed tech companies in recent history have grown as they have because they didn’t just grow their revenues and wealth; core to their products and services has also been building the wealth and revenues of their customers.

As the company builds out its all-in-one finance for SMEs stack, this “growing with customers” will be an important ingredient for retention, uncovering new horizons (i.e. the vision you’re aiming for might not be the biggest vision you can achieve) and carving out a long-term position in the market as the landscape fills up with more fintech players in the years to come.

Looking to take on leadership / executive roles in Aspire or any of our portfolio companies? Explore the opportunities by sending us an email about yourself and what you’re looking for to career@insignia.vc.

Looking to grow your career at one of the fastest-growing fintechs in Southeast Asia while helping businesses in Southeast Asia grow just as fast? For more open roles with Aspire, check out their career page.

References

- https://www.techinasia.com/aspire-capital-seed-funding

- https://techcrunch.com/2019/07/31/aspire-seriesa/

- https://www.businesstimes.com.sg/garage/news/transferwises-valuation-jumps-to-us5b-firm-partners-singapore-neobank-aspire

- http://review.insignia.vc/2020/04/07/aspire-partners-with-visa-and-nium-on-smart-corporate-cards-as-part-of-its-digital-banking-offering-for-businesses/

- http://review.insignia.vc/2020/09/24/neobanking-for-smes-in-southeast-asia-on-call-with-aspire-ceo-and-co-founder-andrea-baronchelli/

- http://review.insignia.vc/2020/07/31/product-leaders-translating-business/

- https://aspireapp.com/case-studies/eezee

- https://techcrunch.com/2021/05/10/aspires-business-accounts-reach-1b-in-annualized-transaction-volume-one-year-after-launching/

- https://techcrunch.com/2021/09/26/aspire-raises-158m-series-b-to-build-a-full-stack-financial-operating-system-for-southeast-asian-businesses/

Paulo Joquiño is a writer and content producer for tech companies, and co-author of the book Navigating ASEANnovation. He is currently Editor of Insignia Business Review, the official publication of Insignia Ventures Partners, and senior content strategist for the venture capital firm, where he started right after graduation. As a university student, he took up multiple work opportunities in content and marketing for startups in Asia. These included interning as an associate at G3 Partners, a Seoul-based marketing agency for tech startups, running tech community engagements at coworking space and business community, ASPACE Philippines, and interning at workspace marketplace FlySpaces. He graduated with a BS Management Engineering at Ateneo de Manila University in 2019.