Highlights

- For first-wave enablers, most of the tech stack has been focused on optimizing business operations facing the consumer.

- Going into the second wave, we will see these frontend enablers become more sophisticated as merchants will be looking for more flexibility and diversifying the ways they can engage their customers.

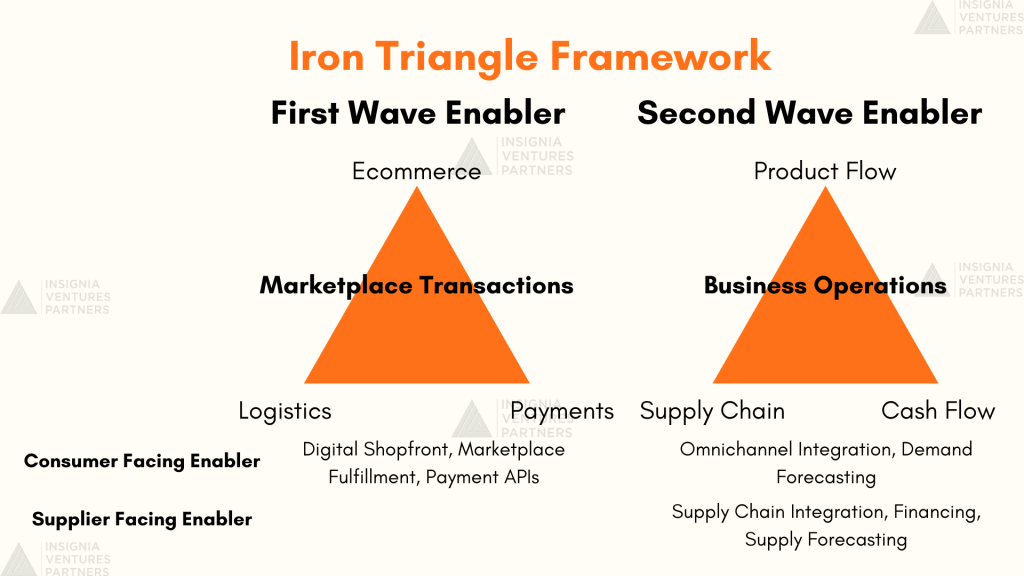

- While the first wave was mostly frontend / consumer-facing enablers and we will continue to see enablers evolve, the second wave has also brought forth backend enablers or supplier-facing enablers.

- Second wave enablers focus more on flows rather than any individual transaction, which is important for monetization as revenues are no longer just be dependent on transaction activity but more on the customer’s business efficiency, which when truly improved, can turn out to be a more sustainable source of value creation.

- The lines of the competitive landscape will be drawn around verticals, and ownership of distribution and stakeholders via the enabler’s platform.

- The emergence of this second wave enabler wave in Indonesia is a sign both of an industry maturing (i.e. thinking beyond transactions) as well as an industry yet to find its footing in an increasing number of possibilities (i.e. thinking beyond ecommerce as we know it). For investors and founders, this is good news as there continue to be more “counter-positions” or opportunities to tap into blue oceans in the market.

In Part 1 of this series on Indonesia’s second wave of ecommerce enablers, we talked about how the rapidly evolving ecommerce or digital-first commerce landscape of Indonesia has been giving rise to a new wave of ecommerce enablers building full stack digital tooling or operating software for specific supply chains, verticals, and products.

Then in Part 2, we took a look at the various go-to-market approaches these enablers are taking, from value chain segment-focused companies introducing digital to offline markets (many features to one vertical) to technology-focused companies building the tech stack for a diverse range of clients (one tech to many use cases). And regardless of the focus, these approaches share a need to form trust, data, and distribution in order to build that “operating software” truly benefitting their target customers.

Finally, in Part 3, we take a look at how this competitive landscape will evolve in Indonesia and the “big picture” goals of some of these enablers, thinking beyond their current focus.

Framing the Competitive Landscape

Another key difference between first wave and second wave enablers we have not really emphasized thus far is that for first wave enablers, most of the tech stack has been focused on optimizing business operations facing the consumer, that is, from the time a customer decides to buy the product (sales) to when they place their order (payment) to how they get their order to their doorstep (logistics).

Going into the second wave, we will see these frontend enablers become more sophisticated as merchants will be looking for more flexibility and diversifying the ways they can engage their customers. This is an effect of more merchants, especially those already exposed to ecommerce marketplaces and first-wave enablers, becoming mature in the way that they understand the digital economy and consumers’ digital behavior.

This means that for these frontend enablers it may actually be more advantageous to build for multiple channels rather than just banking on a single platform for success. From a product standpoint, how interoperable is the solution? From a business standpoint, is monetization tied to a single marketplace or sales channel?

For the ecommerce marketplaces looking to expand into this area of enablement, there will likely be the challenge of figuring out whether to go all-in on ensuring merchants only use their marketplaces or making their tooling more flexible at the risk of cannibalizing their own business.

Apart from enabling omnichannel sales, another level of sophistication for these frontend enablers will be to leverage data for more accurate and real-time demand forecasting.

So while the first wave was mostly frontend / consumer-facing enablers and we will continue to see enablers evolve, the second wave has also brought forth backend enablers or supplier-facing enablers, with a greater focus on improving efficiency around the “cost of goods sold or COGS” section of a business’s balance sheet. In this area of business operations, most merchants still largely use legacy software like Excel or even pen-and-paper for documentation. For backend enablers, it’s not just the buyers who are potential customers in this case, but also the sellers, and for some industries, there is hardly a line between the two.

In the past two parts of these series, we introduced companies like CrediBook and AwanTunai that fall into this category, enabling better supply costing for SMEs through a more accessible pool of goods and SKU management as in the case of CrediBook’s wholesaler marketplace CrediMart, or through embedded supply chain financing as in the case of AwanTunai.

We can expect to see this backend segment of enablement to become more dominant in the second wave for two reasons. First, as we’ve mentioned in Part 1, a large driver for second-wave enablers is to digitize traditionally offline industries, where sales may not be so much of a pain point as it is the costs of backend operations. Second, addressing backend operations in order to eventually optimize for frontend sales may be a more practical way to go considering the importance of trust, data, and distribution in the go-to-market strategies we discussed in Part 2.

Creating operational efficiency in the backend leads to a flywheel effect where better supply sourcing and costing leads to creating healthier cash flow which leads to creating more flexibility for the business to invest in better sales channels and customer engagement, as well as better demand planning.

And when it comes to adoption on the supply side of the equation, more enablers are becoming optimistic as newer generations of business owners or newer players in upstream industries are more open to digital transformation, as B2B textile trading platform Wifkain CEO and co-founder Sara Sofyan shares on call with us.

“On the adoption side, we’re actually quite confident because we see that on the supply side, the suppliers are actually being dominated by younger players now. And hence they are very, very, much more open to digital transformation as opposed to the previous players that are still very sticky to the conventional [methods].”

So when it comes to the competitive landscape, the “operating software for X” trajectory with roots in backend enablement may have an easier time expanding into frontend capabilities, rather than another way around.

Given what we’ve discussed thus far in terms of the segmentation of second-wave enablers, one way to encapsulate these shifts in focus is through Jack Ma’s ecommerce Iron Triangle, which we’ve expanded in the exhibit below to account for second-wave enablers.

So second wave enablers focus more on flows rather than any individual transaction, which is important for monetization as revenues are no longer just be dependent on transaction activity but more on the customer’s business efficiency, which when truly improved, can turn out to be a more sustainable source of value creation.

This can lead to enablers unlocking a variety of interesting business models, like group buying, as Wifkain’s Sara shares as a potential trajectory on the podcast. “I think once the transaction reaches a very clear volume and the data already presents what [particular] fabrics are being purchased or ordered by the Indonesian fashion businesses, they will enable the group buying [service], and hence the merchants can produce a lot more efficiently, with a very minimum operational [costs]. Meanwhile, every brand in Asia can get access to cheap textiles, at a very low minimum quantity. So I think that will be the playbook that we are going to see in the next five years.”

This group buying example is one way that we see enablers potentially embracing both consumer-facing enablement and supplier-facing enablement at the same time.

Big Picture Thoughts of Second-Wave Enablers

As we’ve discussed previously in Part 1 and Part 2, success for these enablers is not just one-off sales of their solutions but building stickiness with their customers over time. This means the lines of the competitive landscape will be drawn around verticals, and ownership of distribution and stakeholders via the enabler’s platform, going back to the idea that industry-specific tools and features are needed due to verticalized sectors.

Now in Part 3, we consider the different perspectives on how this stickiness translates into the bigger picture vision of some of these enablers.

Enabling the whole supply chain

In the case of Wifkain, it’s not just about enabling more efficient B2B textile trading but enabling Indonesia’s entire fashion industry. As Sara shares on our podcast: “Our vision is always to become a supply chain enabler for the whole fashion industry. So after textile, what other adjacencies or other sides or stages in the supply chain of the industry we should kind of solve, and eventually enable the whole supply chain?”

Going further up the supply chain

For AwanTunai, having succeeded in finding product-market fit and continuing to find scale enabling embedded financing and supply chain management for the downstream FMCG suppliers and their merchants, a potential bigger picture is replicating their success further upstream in the supply chain.

As AwanTunai CEO and co-founder Dino Setiawan shares on the podcast: “…we’re certainly staying focused on FMCG and staple foods. It’s still an $80 billion segment. But we do have research projects upstream…to see whether our downstream financing solution works in the upstream where you get those agricultural aggregators, who source supply from hundreds of tiny micro farmers…micro-farm financing has historically had a very difficult history. Very few of these types of farm financing programs have actually worked out. And similarly, the micro merchant space in Indonesia has been littered with a lot of failed banking programs. But given that we’ve solved it on downstream, we certainly hope that we can also solve it for the upstream segment. And that literally means millions of micro-merchants, be it micro retailers or micro farmers.”

Technology-based enablers

Finally for technology-focused enabler Verihubs, building AI-based verification tech stack for a variety of use cases, the big picture means following the evolution of the digital economy, and that could potentially lead to even web3 applications. After all, their solution is most needed where identities need more efficient processing.

“I found that verification is a really, really huge problem and is a huge space and most verification platforms [will] focus on the fintechs and banks. We are trying to focus on not only the fintechs, but also other verification needs such as employee verification, scholarship verification, or medical verification.

There are lots of verification problems that still [need to be] resolved. What I found is that in five years, [we might see more around] verification in the metaverse. We know that the metaverse is really hyped right now; there are lots of metaverse platforms and virtual reality platforms that are growing very fast.

One thing that I haven’t found yet is how a real person of Williem, for example, can be verified in the metaverse. Is the Williem in the metaverse real the real one in the world? And that might be really interesting and challenging for verification platforms to solve.”

While these enablers have painted different big picture ideas on where their solutions and platforms could go long-term, the common thread here is that getting to the big picture is also riding on a lot of external factors and industry momentum, from the other types of tech upgrading to enablers in other economies making moves as well.

The emergence of this second wave enabler wave in Indonesia is a sign both of an industry maturing (i.e. thinking beyond transactions) as well as industry yet to find its footing in an increasing number of possibilities (i.e. thinking beyond ecommerce as we know it). For investors and founders, this is good news as there continues to be more “counter-positions” or opportunities to tap into blue oceans in the market.

Is your company bringing Indonesian commerce to the next level of digital transformation? Reach out to us for a chat or reach out to William Gozali, Head of Indonesia at Insignia Ventures.