Does the super app approach or ecosystem play for platform companies still make sense in today’s market landscape? Throughout this year we’ve seen how many platform companies have rolled back on their ecosystem or portfolio of products and services to focus on core businesses or core markets. JD.com pulled back from Southeast Asia, PropertyGuru shut down two of its business units, and Sea Group wrapped up its investment arm, to name a few.

But this is just one side of the coin. There’s the case of TikTok, once a pure social media play that has been making significant strides in ecommerce enablement in Southeast Asia especially. There’s also examples in our portfolio like Carro and Aspire, which have not only been growing their ecosystems and product stacks, but achieving profitability to boot.

What does it take to grow a profitable platform company in today’s market?

We share some ideas from our latest On Call with Insignia episode with Carro Group CFO Ernest Chew (who came on our show following the company’s announcement of their most profitable quarter yet) and other learnings from our recent coverage of startup finance and generative AI:

(1) Cross-sell and up-sell beyond the platform.

The ecosystem’s products and services have to be interlinked from both a customer and operations perspective. Sounds intuitive, but far more difficult to execute when based on assumptions and not fully data-driven. In this regard, it’s also important to have eyes on attachment rates across all these links being set up. Carro did this to great effect, with 60% of their gross profit coming from ancillaries.

Check out our playbook on product-market fit with frameworks on cross-selling and up-selling

(2) Be mindful of the drivers of each business.

“Whilst complementary and interlinked, the operating drivers of each business are quite different,” Ernest shares on the podcast, referring to Carro’s ancillary businesses. For example, the supply side of growing a car marketplace requires competitively sourced vehicles, but cross-selling financing needs competitive bank financing lines. And this has implications for the priorities and KPIs of each business unit.

As an added note, it is important for finance functions, especially for a venture-backed company, to be built around this understanding, as opposed to being a siloed watchdog.

(3) Keep OPEX lean (with AI).

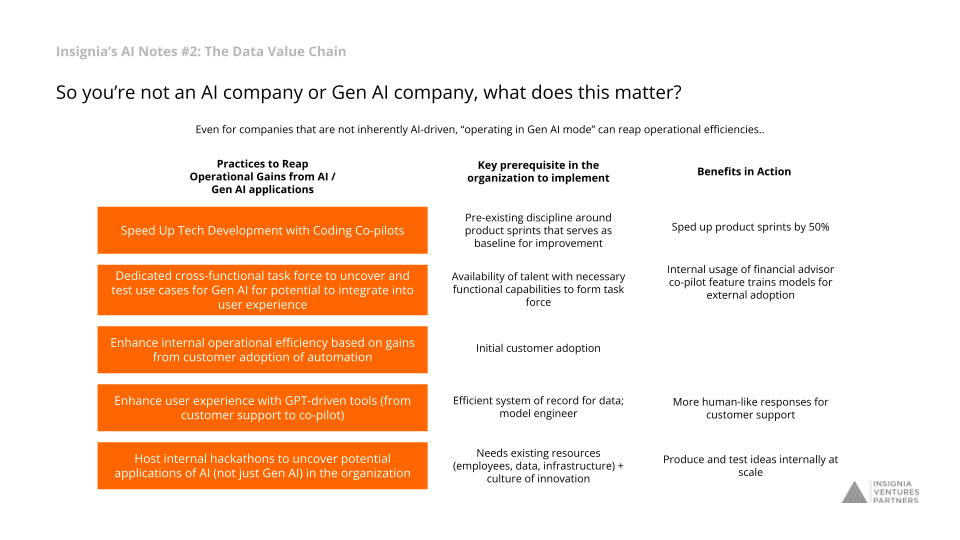

Ensure there’s no duplication of costs in various businesses. This is where AI, and in particular, LLMs and generative AI technologies can come in from an operational standpoint and reduce costs on shared processes across business units (e.g., an autonomous AI agent managing a car across its journey from seller to buyer to maintenance, etc.).

“So you’re not an AI company or Gen AI company, what does this matter?” From our AI Notes #2

(4) Have eyes on cash flows and liquidity from early on.

More often than not, building a venture-backed platform business will not be profitable out the gate. Growth and/or technology demands will mean higher ramp up costs and working capital, (plus some GTM business units like marketplaces often sacrifice margins for scale), but if offset by effective cross-sell and up-sell strategies, can ease out a healthy balance of growth and profitability over time.

Equity investors understand this, but market pressures are affecting these expectations. Regardless, throughout this whole journey, it is key to have the finance capabilities to manage this lifeblood and set boundaries for the business.

(5) Leverage the right strategic partnerships.

In the case of Carro, being one of the few startups invested in by blue chip strategic partners like Sime Darby, Mitsubishi, MSIG, DRB-Hicom, and most recently JC&C (again all aligned with their ecosystem) has reaped benefits in terms of securing globally competitive supply and enhancing their existing business capabilities. And these partnerships are not just transactional investments or gains largely for Carro alone. It is important to build win-win scenarios over time, with Carro bringing its AI and tech capabilities to the table.

As Ernest puts it, “It’s very important to build partnerships that leverage on each other’s strength to deliver a strategic win-win outcome. That is the tenet of sustainable partnerships. For instance, how can we help our new car dealer partners to sell more new vehicles by providing used car vehicle trading solutions, or how do we help them navigate and address inventory management?”

Bringing Balance Back to Growth and Profitability

In many ways, what it takes to build a platform company in today’s market has not actually changed (Check out this podcast with Yinglan back in 2020). Arguably, the super app approach is still relevant for the right market segment and with the right go-to-market.

Building a platform company is still about achieving retention-driven growth, building a business that remains tightly connected even at scale, and leveraging creative ways to operate lean at scale (whether that’s unlocking partnerships or new technologies). Today’s market has instead demanded more focus (in growth) and discipline (in financial management) to bring balance back to these platform companies.

Indeed, one can’t go one way or another. As Ernest puts it on our podcast, “The key word across all things that we do is balance, not overgrowing and burning excessively on one end, nor becoming extremely profitable degrowing, destroying customer satisfaction, et cetera.”

The key word across all things that we do is balance, not overgrowing and burning excessively on one end, nor becoming extremely profitable degrowing, destroying customer satisfaction, et cetera.

Paulo Joquiño is a writer and content producer for tech companies, and co-author of the book Navigating ASEANnovation. He is currently Editor of Insignia Business Review, the official publication of Insignia Ventures Partners, and senior content strategist for the venture capital firm, where he started right after graduation. As a university student, he took up multiple work opportunities in content and marketing for startups in Asia. These included interning as an associate at G3 Partners, a Seoul-based marketing agency for tech startups, running tech community engagements at coworking space and business community, ASPACE Philippines, and interning at workspace marketplace FlySpaces. He graduated with a BS Management Engineering at Ateneo de Manila University in 2019.