“2024 will be the year of turning a corner.

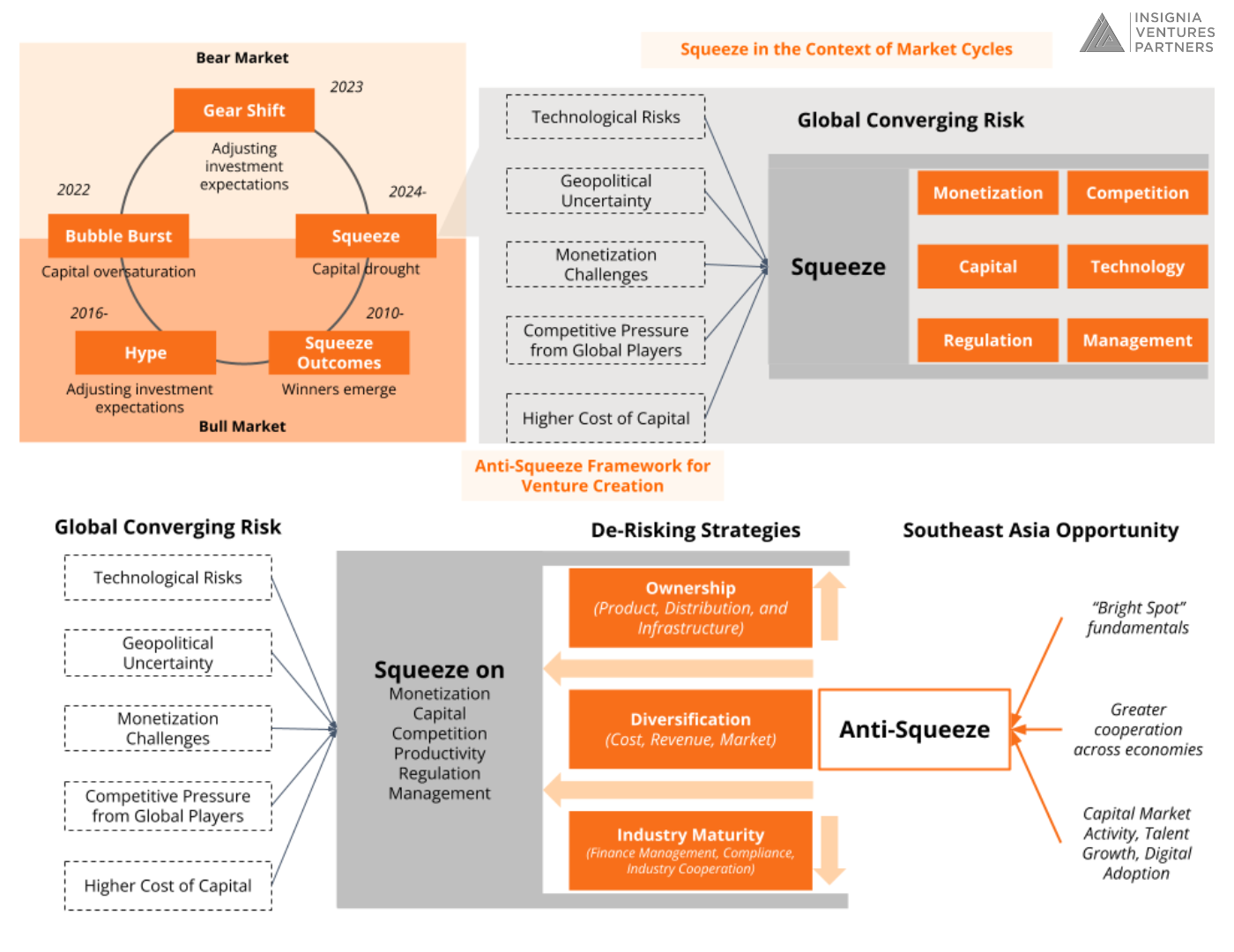

And it will be a tight corner, with pressures from geopolitics, interest rates, public markets, a maturing competitive landscape impacting monetization (margins) and capital allocation for tech companies. It will also be a corner without a clear end given the “squeeze” from these external factors.

Read more on the squeezes of 2023 in this article

The opportunity here is to find entrepreneurs and companies that have built up “anti-squeeze”, optimizing what is in their control (e.g., costs, growth strategy) to resist pressures and become capital efficient in growth.”

This quote is from Yinglan in a recent CNBC piece on the VC outlook on Southeast Asia’s funding winter going into 2024.

But how can startups build up this “anti-squeeze” muscle exactly?

We first zoom out and look at the dynamic between market cycles, the result squeezes on startup building, and the characteristics of an anti-squeeze company: one that develops ownership, diversification, and industry maturity over time.

The Six Squeezes and the Anti-Squeeze Principle for the Southeast Asia Startup

Historically, periods of bull runs and speculative bubbles are often followed by periods of “squeeze,” where macroeconomic pressures constrain cash flow and monetization for companies. But particularly in 2024, there are even more pressures unique to this time period (e.g., geopolitics, technology). In such periods, companies able to exercise “anti-squeeze”, or the ability to nullify these risks or reduce their effects, will thrive and lead industries.

Anti-squeeze is all about de-risking. That will often happen through a company acquiring more ownership over product, distribution, and infrastructure (as opposed to being purely asset-light), diversifying its sources of cost, capital, revenue, and market (as opposed to placing on bets on a pure platform play), and driving industry maturity (as opposed to the well-documented “move fast and break things” approach).

To better illustrate our point, we share some examples.

These frameworks take inspiration from Insignia Ventures Partners portfolio companies and their stories of resilience, as we’ve documented over the years on Insignia Business Review.

The Anti-Squeeze Startup Develops Product, Distribution, and Infrastructure Ownership

Anti-squeeze is about de-risking uncertainties through ownership. For example:

AwanTunai: A story of going through what was at the time the worst credit cycle in recent history to achieve 3% NPL (for traditional offline MSMEs in Indonesia) amidst the pandemic in 2020 by deploying *owned infrastructure*, specifically their ERP for MSMEs to streamline data collection and manage risk.

We recommend revisiting our 2021 podcast with CEO Dino Setiawan (fresh from overcoming their 2021 challenges), taking a look at our case study format review of AwanTunai’s pandemic journey, then moving to our latest conversation with him in 2023.

Super: A story of continuously building up ownership to tackle the challenging fragmentation and margins of growing a business in Rural Indonesia, from building up group buying social commerce to have “owned” distribution to developing white label brands to have “owned” SKUs.

We recommend checking out our commentary on the Harvard Business School case study documenting the origins of Super in social commerce, then jumping onto our conversation with Super’s Heads of Business Development and Innovation for more on their white label strategy.

The Anti-Squeeze Startup Diversifies Revenue, Cost, and Market through Ecosystem Building

Anti-squeeze is about de-risking market pressures through diversification. For example:

Carro: A story of achieving record profitability and scale in challenging market conditions for the car marketplace sector globally, by investing in its adjacencies (diversifying sources of revenue) and leveraging multi-market cross-pollination (diversifying margins and cost of capital).

We recommend this case study format review of Carro’s journey from 2022 then listening into their CFO’s take on achieving record profitability and scale.

Pinhome: A story of launching a startup focused on real estate during the pandemic, and through a range of partnerships across the industry (diversifying supply), built this into the most comprehensive proptech ecosystem globally serving the needs of millions of homebuyers in Indonesia.

We recommend this podcast recap of the Pinhome journey, as well as our latest podcast with them.

The Anti-Squeeze Startup Develops Industry Maturity through Financial Management, Compliance, and Cooperation

Anti-squeeze is about de-risking regulatory uncertainties by driving industry maturity. For example:

Ajaib: A story of tapping into the market for next generation millennial investors and pioneering digital-first licensed stock brokerage in Indonesia amidst the pandemic in 2020

We recommend this case study format review of Ajaib’s journey leading up to their billion dollar valuation round, and this podcast in 2022 with CEO Anderson Sumarli

Fazz (StraitsX): A story that began with an idea in 2017 to have local stable coins, leading to a product launch in 2019, and most recently in 2023 regulatory IPA for the issuance of compliant digital currencies.

We recommend this podcast with Tianwei back in 2022, where he recounts this journey, and stay tuned for our catch up with him next year!

Paulo Joquiño is a writer and content producer for tech companies, and co-author of the book Navigating ASEANnovation. He is currently Editor of Insignia Business Review, the official publication of Insignia Ventures Partners, and senior content strategist for the venture capital firm, where he started right after graduation. As a university student, he took up multiple work opportunities in content and marketing for startups in Asia. These included interning as an associate at G3 Partners, a Seoul-based marketing agency for tech startups, running tech community engagements at coworking space and business community, ASPACE Philippines, and interning at workspace marketplace FlySpaces. He graduated with a BS Management Engineering at Ateneo de Manila University in 2019.