In this article, we explore another key theme in Southeast Asia innovation today: embedded finance and its implications for startups in the region.

Check out the last theme we explored on the talent influx into the region, especially from China.

While the past decade of Southeast Asia’s digital economy was driven by this concept of the “marketplace”, the next decade will arguably be driven by digital finance.

Whereas before it was all about a meeting of offline supply and demand orchestrated online, moving forward it will be about ensuring the continued cashflow underlying this supply and demand movement.

How will suppliers be able to keep up with demand for their products given the speed of digital transactions? How will demand continue to be retained (i.e., their wallets / accounts) on various platforms and continue to be engaged in these consumer experiences?

Fintech Revenues, Funding on the Rise, and Embedded Finance at the Heart of It

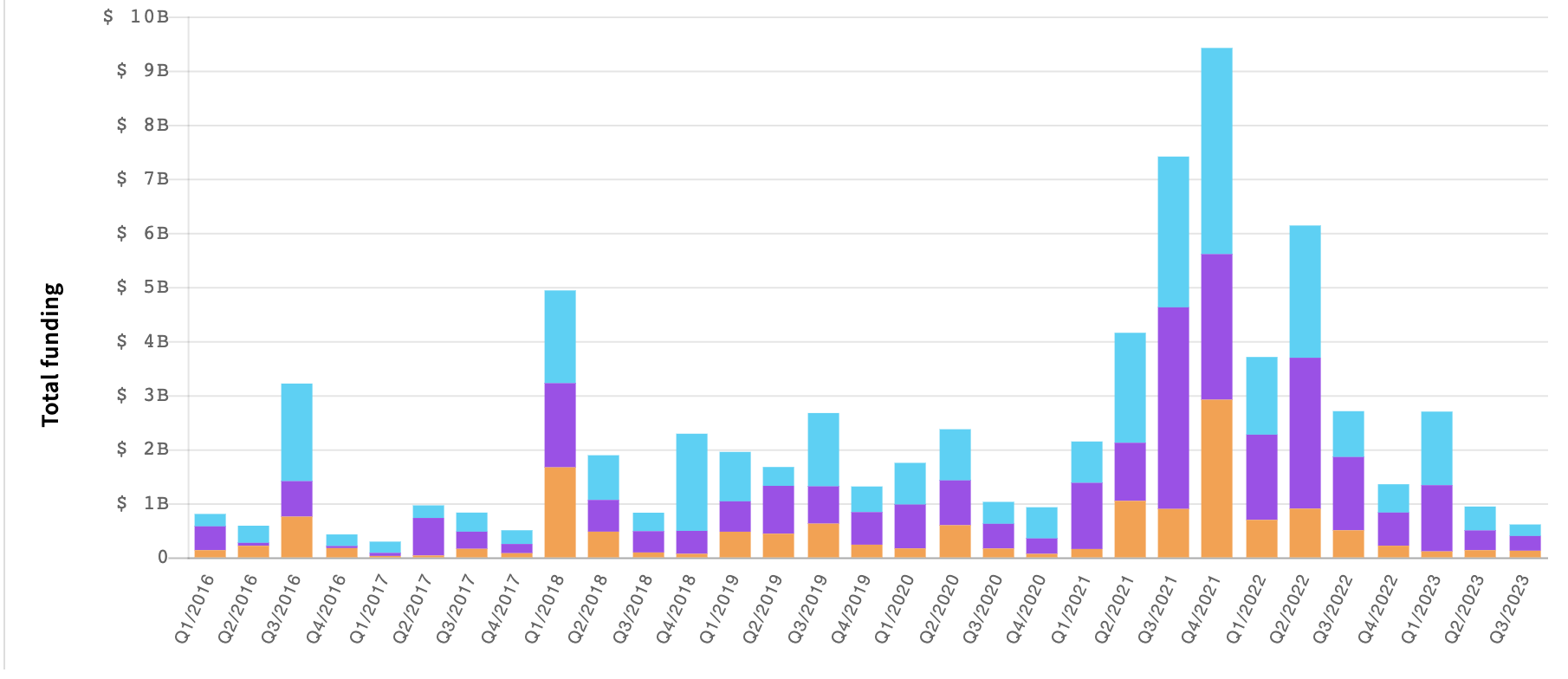

Already we see that venture funding in the last six to eight quarters (post-pandemic), save one, saw finance taking on more funding than commerce or consumer verticals.

Finance is leading the way. From Insignia’s Private Market Statistics tool. Blue is commerce, Purple is finance, orange is consumer.

But when it comes to revenues, globally fintechs represent less than 2% of annual financial services.

This is rapidly changing however, with revenues projected to grow more than sixfold from 2021 to 2030 to reach US$1.5 trillion. The growth will be concentrated in North America and APAC, with the latter projected to grow 8.5X in revenues. And at the heart of it are B2B and B2B2X fintechs, projected to grow 11x and 7.5x to 440B and 285B revenues respectively.

In Southeast Asia alone, fintechs facilitate over US$320B in transaction value (digital payments, digital capital raising, neobanking) and generate over US$6B in revenue. This aligns with Indonesia seeing fintech growth going from 51 in 2011 to 334 in 2022. Even amidst the funding winter in 2022, VC investments in Singaporean fintech startups reached a peak of US$2.31 billion, up 13% from a year ago.

Open Finance and Financing Innovation: Democratizing Data and Infrastructure

Over the past decade in Southeast Asia, fintechs were developed in response to specific needs especially around payments (from the customer POV) and monetization (from the fintech’s POV). This eventually expanded to what is called the “unbundling of the bank”.

While this grew the fintech industry in the region, fintechs have remained largely fragmented across markets, applications, and customer journeys. These products have also largely been standalone or plugged into other platforms separately.

But in recent years, there have been two key developments shifting they way fintechs are being built and approach growth.

First is the emergence of open finance and API/infrastructure adoption across all types of businesses, from SMEs to banks and FIs.

There are companies like open finance pioneer Brankas that have been democratizing aggregated API solutions and financial infrastructure access. This enables financial services to be embedded in customer journeys like transportation and healthcare. It also enables more secure and transparent data access and sharing for banks and FIs as they offer new products or partner with other companies to do so.

Regional fintech group Fazz has also been making financial services more accessible to businesses, enabling a wide range of capabilities from linkages to Singapore’s payment system and the issuance of Visa cards for customers to payments with digital assets.

What makes Fazz’s approach more interesting is the group also offers products around business operations management for Indonesian clients, which strengthens their financial service propositions around invoice and purchase order financing.

This marriage of business operations management with financial services leads into the second key development: new forms of data workflows powering financial services.

This is most applicable in business financing, where you have fintechs developing novel approaches to underwriting un-collateralized loans. AwanTunai in Indonesia uses supply chain data through their proprietary ERP system powering their customer’s backend operations.

First Circle in the Philippines has used revolving invoice financing to make capital more accessible to businesses across different ARR segments (with corresponding lending limits).

Impact of Embedded Finance on Startups in Southeast Asia

The confluence of key data and infrastructure access being developed by fintechs like the ones we’ve mentioned above has meant that the barriers to consolidating fintech use cases and plugging them into digital experiences has gone significantly lower. For example, Verihubs has tallied around 70% cost reduction on average when it comes to their AI-powered verification solutions, which have largely served financial institutions and fintechs in their KYC processes.

This will impact the way startups (not just fintechs) are built in three ways:

Lower cost to build owned financial services integrated into customer journeys from day one.

We’ve seen this with the likes of Carro, with Genie Finance being one of the earliest auxiliary businesses set up. The used car platform’s financing and insurance businesses tie into their AI/ML capabilities as well, for example, through distance-based and behavioural-based insurance premiums.

More on how their auxiliary businesses have contributed to their profitability from Carro CFO Ernest Chew:

Proptech Pinhome has done this to great effect as well, as CEO Dayu Dara Permata describes on our latest podcast with them:

”Mortgage entry points that are attached to the brokerage home-search journey are right there in the listing. As they are scrolling through the listings, they can see their mortgage availability, which banks are available for this particular listing, and what’s going to be the monthly installment for them, what kind of interest they’ll be paying.

Agent invoice financing is attached to the home transaction that the agent is facilitating. So as agents are completing property transactions, they are eligible for commission, which they might not get immediately because there’s always sometimes a lead time before they can get their commissions.

So they then have the option to explore potential financing. And last but not the least, primary project financing is also attached to the developer onboarding journey. Of course, it’s going to be very selective. So we have a product that explores financing for primary property developers with highly attractive, highly sellable projects. And that’s also somehow embedded in the developer onboarding journey in the platform.”

For Pinhome in particular, the nature of their ecosystem has allowed them to leverage financial services to retain partners on the supply and intermediary sides of the business.

Dara also shares a story of how embedded finance has allowed Pinhome customers to access mortgage that they would have otherwise taken much longer to secure, if at all, using traditional means:

”We have a content creator who got her first mortgage with Pinhome after previously trying on her own multiple times and getting rejected to the point that she wanted to give up. Despite earning a good amount of money as a content creator, this type of career is what is considered by banks as a non-fixed income professional.

Through our in-app chat with our virtual mortgage consultant, she was advised to use a mortgage pre-qualification feature. She pre-qualified herself in less than a minute. And our algorithm helped to identify the best bank with the right eligibility criteria that would accept non-fixed income professionals.

Out of the 40 bank options available at Pinhome, one or two banks were relevant for her, and she submitted her application online, got confirmation that she was being processed, and within days received approval.”

More on the podcast:

Clearer pathways to rebundling the banking stack for personal finance

In a podcast last year, Ajaib CEO Anderson Sumarli talked about how the lines between saving and investing have been blurring. Embedded finance is not only enabling fintech services to be embedded onto commerce transactions but also on other fintech services as well. Ajaib’s platform for example enables investing into several different asset classes.

Flip’s money transfer platform in Indonesia especially for small businesses, enables payments for a single business to all its stakeholders: suppliers, employees, and customers. As Flip COO Gita Prihanto shares on our podcast:

“Micropreneurs are people who either have home businesses or small businesses as their core income or have another business on the side. And they like to use Flip to make payments to their suppliers and to their employees. Sometimes they ask their customers to send money through Flip.”

More on the podcast:

Tonik on the other hand has recently launched an insurance product tied to its loans in partnership with Sun Life Grepa Financial.

The Philippine digital bank has also developed ways to “embed” repayments for loans in different channels, as CEO Greg Krasnov describes on our podcast:

“We’re currently working on an additional way for the customers to top up their account and repay the loans specifically, which is Tonik as a biller. So we’re working on getting integrated as a biller in a number of the billing systems out there. So that they can just pay directly to their loan account without having to go through the TSA.

We also have a product, our Flex Loan, which makes it super easy for the customer. If they have a salary account, all they have to do is just activate their debit card with us and we’ll just charge the debit card monthly for them. And then they don’t even have to think; it’s just automatic.”

More on the podcast:

More fintechs for industry enablers to partner with for financing

This is especially applicable for agriculture, fisheries, and aquaculture.

Indonesian upstream agritech Elevarm provides on-farm facilities for their farmers to access affordable insurance and finanacing through a pay later system. As CTO Febi Agil Ifdillah shares on our podcast:

“We deploy an ecosystem approach where we build clusters. In each cluster, we build an ecosystem that consists of on-time facilities. So we leverage the power of being present right in the heart of the farming area through on-facility, which we call AgriPoint.

So that’s one of our facilities, which provides high-quality active inputs to post-solutions marketing, good solutions, access to uncomplicated financing, and of course, a knowledge center as well for small projects. And over time, the kind of facilities that we built within the cluster has also evolved, including currently building nurseries, partnering with local growers as well to build seed-link centers, etc. So it’s bottom-up problem discovery and also solutions that we deploy with each cluster.”

More on the podcast:

What’s the catch of embedded finance?

From products embedded throughout customer journeys to the fintech products embedded within fintech ecosystems and greater access to financial services through embedded partnerships, fintech is indeed increasingly becoming everywhere.

But it is not without risk, a key question moving forward is, what are the risks with embedded finance’s rapid development and roll-up of financial services into all kinds of applications?

Sources

- https://www.statista.com/outlook/dmo/fintech/southeast-asia#transaction-value

- https://www.linkedin.com/pulse/fintech-evergreen-southeast-asia-hyphenpartners/

- https://acv.vc/insights/acv-portfolio-news/ac-ventures-boston-consulting-group-fintech-report/

- https://web-assets.bcg.com/69/51/f9ce8b47419fb0bb9aeb50a77ee6/bcg-qed-global-fintech-report-2023-reimagining-the-future-of-finance-may-2023.pdf

Paulo Joquiño is a writer and content producer for tech companies, and co-author of the book Navigating ASEANnovation. He is currently Editor of Insignia Business Review, the official publication of Insignia Ventures Partners, and senior content strategist for the venture capital firm, where he started right after graduation. As a university student, he took up multiple work opportunities in content and marketing for startups in Asia. These included interning as an associate at G3 Partners, a Seoul-based marketing agency for tech startups, running tech community engagements at coworking space and business community, ASPACE Philippines, and interning at workspace marketplace FlySpaces. He graduated with a BS Management Engineering at Ateneo de Manila University in 2019.